- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Lockheed Martin Secures $77.7-Million Cyber Security Contract

Lockheed Martin Corp. ( (NYSE:LMT) ) recently secured a contract for providing cyber security support services to sustain the analysis, design, development, test, integration, deployment and operation of information technology systems and services for the cyber security workforce. Work related to the deal is scheduled to be over by December 2022.

Valued at $77.7 million, the contract was awarded by the Naval Air Warfare Center Weapons Division, China Lake, CA. Majority of the work will be carried out in China Lake, CA. Lockheed Martin will utilize fiscal 2018 working capital funds (Navy) to partially finance the deal.

Cyber Security Solutions

Lockheed Martin is a leading provider of a full spectrum of cyber capabilities supporting the defense and intelligence community customers. The company offers cyber security solutions to defend and exploit enterprise IT networks, radiofrequency spectrums, and military platforms on land, sea and air.

The company’s Cyber Kill Chain framework is part of the Intelligence Driven Defense model built for identification and prevention of cyber intrusions and enriches an analyst’s understanding of an adversary’s tactics, techniques and procedures.

Our View

For the U.S. Navy, cyber security is critical because its ability to coordinate ships, planes and personnel depends heavily on computer networks and satellites. This paves way for a big defense contractor like Lockheed Martin to deliver extensive cyber solutions which enable the U.S. Defense to manage cyber intrusions, insider threats and supply chain vulnerabilities.

Meanwhile, the fiscal 2018 budget allocated $1.5 billion to Homeland Security for countering cyber attacks, strengthening networking surveillance systems and protecting critical data-based infrastructure. This in turn is expected to help the company clinch more contracts related to cyber security.

Notably, the company’s Rotary and Mission Systems business that offers cyber security solutions witnessed a mere 0.2% top-line rise in the third quarter of 2017. Despite this inappreciable top-line improvement, the company has raised its 2017 sales outlook for this business unit. We may expect this enhanced guidance to have been driven by anticipations of more such contract wins like the latest one.

Price Movement

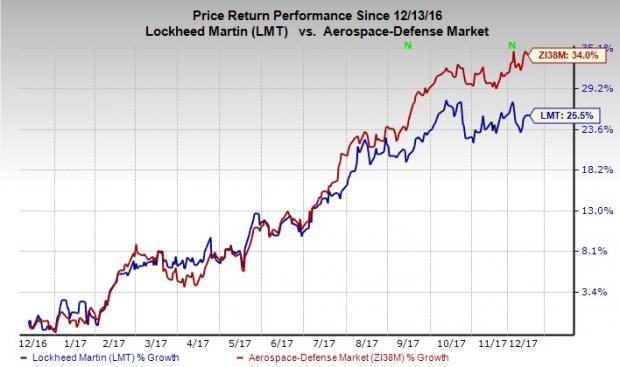

Lockheed Martin’s stock has rallied about 25.5% in a year compared with the broader industry’s 34%. This underperformance was primarily led by intense competition in the domestic and international markets.

Zacks Rank & Key Picks

Lockheed Martin carries a Zacks Rank #3 (Hold). A few better-ranked stocks from the same sector includes Curtiss-Wright Corporation (NYSE:CW) , Leidos Holdings, Inc. ( (NYSE:LDOS) ) and Huntington Ingalls Industries, Inc. (NYSE:HII) . While Curtiss-Wright sports a Zacks Rank #1 (Strong Buy), Leidos Holdings and Huntington Ingalls carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Curtiss-Wright Corporation Curtiss-Wright Corporation posted an average positive earnings surprise of 11.78% for the past four quarters. The Zacks Consensus Estimate for current-quarter earnings rose by 22 cents over the last 60 days.

Leidos Holdings has an average positive earnings surprise of 14.81% for the past four quarters. The Zacks Consensus Estimate for current-year earnings has improved by a penny in the past 30 days.

Huntington Ingalls posted an average positive earnings surprise of 14.22% for the last four quarters. The Zacks Consensus Estimate for current-year earnings has risen by 48 cents in the past 60 days.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Lockheed Martin Corporation (LMT): Free Stock Analysis Report

Huntington Ingalls Industries, Inc. (HII): Free Stock Analysis Report

Leidos Holdings, Inc. (LDOS): Free Stock Analysis Report

Curtiss-Wright Corporation (CW): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Every investor should know the term CEP, or customer engagement platform, because it is central to businesses' use of AI. CEPs provide software services to connect and communicate...

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.