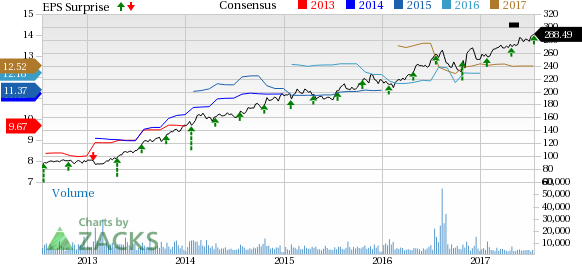

Pentagon’s prime defense contractor, Lockheed Martin Corp. (NYSE:LMT) reported second-quarter 2017 earnings from continuing operations of $3.23 per share, beating the Zacks Consensus Estimate of $3.10 by 4.2%. Earnings also surpassed the year-ago period’s bottom-line figure by 10.2%.

Operational Highlights

In the reported quarter, total revenue came in at $12.69 billion, which surpassed the Zacks Consensus Estimate of $12.47 billion by 1.8%.

Moreover, the company’s revenues increased 6.6% from $11.56 billion a year ago. Notably, all segments registered year-over-year growth in sales, except Missiles and Fire Control.

Backlog

Lockheed Martin ended the second quarter (on Jun 26, 2017) with $92.1 billion in backlog, down 1.5% from $93.5 billion at the end of the first quarter. Of this, the Aeronautics segment accounted for $32 billion while Rotary and Mission Systems contributed $26.7 billion. Also, $18.4 billion came from Space Systems, and $15 billion from Missiles and Fire Control.

Segmental Performance

Aeronautics: Sales increased 19% year over year to $5.2 billion, driven by higher net sales for the F-35, C-130 as well as C-5 programs.

Operating profit also advanced 15% year over year to $550 million, while operating margin dropped 40 basis points (bps) to 10.5%.

Missiles and Fire Control: Quarterly sales dropped 3% year over year to $1.6 billion due to slower sales from air and missile defense programs.

Operating profit increased 6% year over year to $268 million and operating margin expanded 130 bps to 16.4%.

Rotary and Mission Systems: Quarterly sales of $3.4 billion increased 3% from the prior-year quarter on higher revenues from Sikorsky as well as C4ISR & undersea systems & sensors (C4USS) programs.

Operating profit improved 26% year over year to $254 million, while operating margin expanded 130 bps to 7.4%.

Space Systems: Sales increased 9% year over year to about $2.4 billion in the second quarter, driven by sales improvement owing to the company’s increased interest in Atomic Weapons Establishment Venture.

Operating profit dropped 25% to $256 million while operating margin contracted 470 bps to 10.6% in the quarter.

Financial Condition

Cash and cash equivalents were $2.45 billion as of Mar 26, 2017 compared with $2.22 billion at the end of the first quarter. Long-term debt was $14.28 billion, almost in line with the first-quarter end level.

Cash from operations at the end of the second quarter was $3.2 billion compared with the first quarter’s level of $3.1 billion.

During the quarter, the company repurchased 1.9 million shares for $500 million compared with the buyback of 2.1 million shares for $501 million a year ago. The company paid dividends worth $525 million to its shareholders compared with the year-ago period’s level of $501 million.

Guidance

For 2017, Lockheed Martin has raised its financial guidance. The company expects to generate revenues in the range of $49.8–$51.0 billion, higher than the earlier provided projection of $49.5–$50.7 billion.

On the bottom-line front, the company now expects its earnings per share to be in the range of $12.30–$12.60 during 2017, higher than the earlier-announced guidance range of $12.15–$12.45.

However, the company has retained its 2017 expectations for cash from operations. Lockheed Martin continues to expect more than $6 billion cash from operations.

Zacks Rank

Lockheed Martin carries a Zacks Rank #3 (Hold).

Upcoming Peer Releases

Huntington Ingalls Industries, Inc. (NYSE:HII) is expected to report second-quarter 2017 results on Aug 3. The company has an Earnings ESP of +4.96% and a Zacks Rank #2. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Raytheon Company (NYSE:RTN) is expected to report second-quarter 2017 results on Jul 27. The company has an Earnings ESP of +0.57% and a Zacks Rank #3.You can see the complete list of today’s Zacks #1 Rank stocks here.

General Dynamics Corp. (NYSE:GD) is expected to report second-quarter 2017 results on Jul 26. The company has an Earnings ESP of +1.24% and a Zacks Rank #3.

5 Trades Could Profit ""Big-League"" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

General Dynamics Corporation (GD): Free Stock Analysis Report

Lockheed Martin Corporation (LMT): Free Stock Analysis Report

Huntington Ingalls Industries, Inc. (HII): Free Stock Analysis Report

Raytheon Company (RTN): Free Stock Analysis Report

Original post

Zacks Investment Research