Investing.com’s stocks of the week

MetalMiner’s Stuart Burns touched on the rapid swing back downward for the aluminum price, which surged on news of US sanctions on Russian oligarchs and companies but quickly dropped when the US Treasury opened the door to potential easing of sanctions.

But aluminum wasn’t the only metal to see its price drop precipitously in the last week.

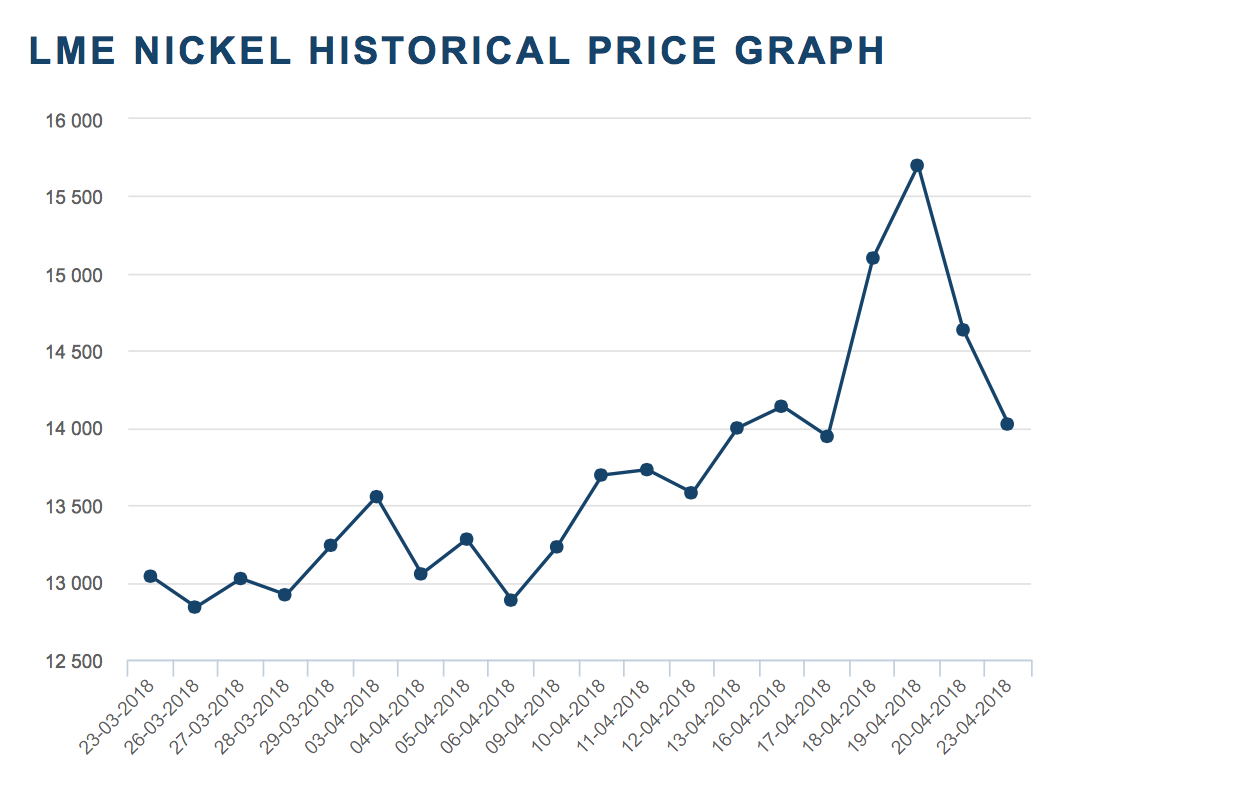

Nickel rose 15.8% between April 3 and April 19, from $13,555/mt to $15,700/mt. That surge has reversed, however, in recent days.

From that $15,700/mt mark, the price has dropped 10.7%, down to $14,025/mt as of April 23.

LME nickel price. Source: LME

The nickel price jumped 10% in a single day last week, the Financial Times reported, marking the biggest one-day jump since 2008, on concerns regarding the potential for sanctions to spread to Russian firm Norilsk Nickel.

Norilsk, however, was not among the 12 companies listed in the sanctions announced by the US Treasury April 6.

Nonetheless, with the US Treasury opening the door for the easing of sanctions if Russian oligarch Oleg Deripaska steps down from his role with aluminum giant Rusal — one of the companies listed in the initial sanctions announcement — the price of aluminum and other metals, like nickel, have tracked back down.

Given Rusal’s stake in Norilsk, last week’s fears regarding a potential supply crunch have for now been somewhat allayed. As such, with the Treasury’s softened stance on sanctions, prices have come back down.

On Monday, the Treasury extended the deadline for US individuals to wind down activities with Rusal to Oct. 23.

“RUSAL has felt the impact of US sanctions because of its entanglement with Oleg Deripaska, but the US government is not targeting the hardworking people who depend on RUSAL and its subsidiaries,” Treasury Secretary Steven Mnuchin said in a prepared statement. “RUSAL has approached us to petition for delisting. Given the impact on our partners and allies, we are issuing a general license extending the maintenance and wind-down period while we consider RUSAL’s petition.”

At least for now, that’s good news for electric vehicle manufacturers, who are increasingly looking to nickel for use in lithium-ion batteriesI

by Fouad Egbaria