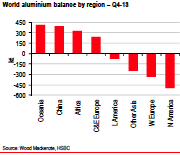

Aluminum supply shortfalls have been most marked in the US, which is where the largest physical premiums have manifested themselves, followed by Europe and Japan.

So here comes the bit you are all waiting for – if the market is in deficit and demand remains robust, what will happen to prices?

Well, in HSBC’s opinion, we will see them rise, but not dramatically.

That massive overhang of global inventory is not about to come rushing back onto the market, but its very presence will dampen speculative expectations.

Having averaged around $1,847 per metric ton during 2013, aluminum prices will be rising in 2014 to average out at around $1,950, according to HSBC, as prices are currently in the low $1,700s and look like they may average not much over $1,750 in the first quarter; that suggests a period later in the year of over $2,000 per ton.

Of course, any consumer will tell you they are already paying well over $2,000 because the LME price is only part of the story. On top of the current $1,730 or so per ton is another $400-450/ton of physical premium, making the actual market price more like $2,200 today.

And that is where HSBC is a little vague.

The price predictions of $1,950 per ton for 2014, $2,050 per ton for 2015 and $2,150 per ton for 2016 are indeed LME prices, but they make the point (almost as a footnote) that the physical premium and the LME price will come more into line, the former falling as the latter rises, as historically they always were with a physical premium of no more than $100/ton.

If we add a more “normal” premium of, say, $100/ton onto an LME price of $2,050, then the bank is not expecting actual prices for consumers to rise at all by next year.

The wording suggests HSBC does not expect the premia to return to such levels quickly, though; the year mentioned for “normalization” is indicated as more like 2017, so we can take it the bank is predicting modest – but only modest – rises in consumer prices, as the LME price gradually increases and the premia gradually subside.

by Stuart Burns