Zinc fundamentals may not be bright as International Lead and Zinc Study Group (ILZG) has forecasted a small decline in world demand for refined zinc metal in 2012 at 12.71 mn tons while in 2013 it may rise 3.8% to 13.9 mn tons.

Global zinc mine output is forecast to increase by 5% in 2012 to 13.60 million tonnes and a further 2.7% in 2013 to 13.96 million tonnes.

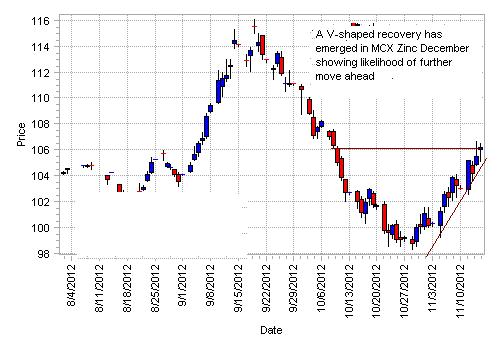

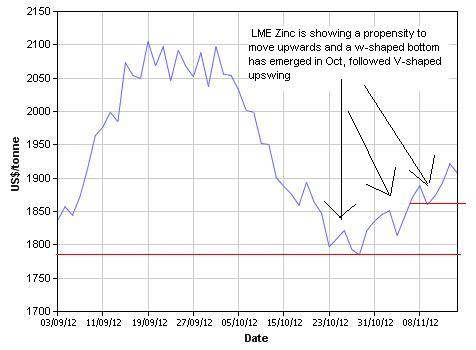

Technical charts (below) show zinc is witnessing a rebound from lows recently rising to $1921.50 per ton levels and having solid support at $1790 and immediate support at $1860 levels. The charts show two W-shape bottoms signaling a positive move upwards in the near future. On the other hand, on MCX MCX Zinc December chart above is showing a V-Shaped recovery and ascending triangle formation in the charts paving the way for further upside moves. 3LME Zinc settlement price fell to $1907 from a recent high of $1907 but inventory fell by 2825 tons on Thursday trading.

3LME Zinc settlement price fell to $1907 from a recent high of $1907 but inventory fell by 2825 tons on Thursday trading.

Meanwhile, news reports said that China State Reserve Bureau has issued a tender on Thursday to buy 100,000 mt of refined zinc from domestic smelters to shore up prices. The stockpiling activity is expected to provide firm support to zinc prices.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

LME, MCX Zinc Charts Signaling W-V Shaped Recovery

Published 11/19/2012, 01:06 AM

Updated 05/14/2017, 06:45 AM

LME, MCX Zinc Charts Signaling W-V Shaped Recovery

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.