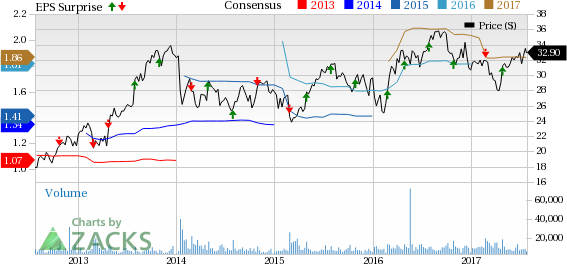

LKQ Corporation’s (NASDAQ:LKQ) second-quarter 2017 adjusted earnings from continuing operations of 53 cents per share beat the Zacks Consensus Estimate by a penny. The prior-year quarter bottom line was 52 cents.

LKQ Corp registered record revenues of $2.46 billion, up 6.7% year over year. Revenues also surpassed the Zacks Consensus Estimate of $2.41 billion.

Business Developments

In second-quarter 2017, LKQ Corp acquired 7 companies.

Also, during the quarter, European operations of LKQ Corp opened one new branch in the U.K. and 12 new branches in Eastern Europe.

Financial Position

LKQ Corp had cash and cash equivalent of $303.5 million as of Jun 30, 2017, compared with $227.4 million as of Dec 31, 2016.

In the first-half of 2017, LKQ Corp had net cash provided by operating activities of $362.1 million compared with $361.9 million in the first half of fiscal 2016.

2017 Outlook

For 2017, LKQ Corp expects organic revenue growth for parts & services in the range of 4–5.25%, revising from prior guidance of 4% to 6%.

Adjusted income from continuing operations is expected between $570−$595 million, from the prior expectation of $565−$595 million. Adjusted earnings per share in 2017 are expected to be in the range of $1.84–$1.92, up from the prior expectation of $1.82–$1.92.

Zacks Rank and Top Picks

LKQ Corp currently carries a Zacks Rank #4 (Sell).

Some better-ranked companies in the same space are Allison Transmission Holdings (NYSE:ALSN) , Volkswagen (DE:VOWG_p) AG (OTC:VLKAY) and Daimler AG (OTC:DDAIF) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Allison Transmission has an expected long-term growth rate of 11%.

Volkswagen has expected growth rate of around 17.3% for the long run.

Daimler has an expected long-term growth rate of 2.8%.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Daimler AG (DDAIF): Free Stock Analysis Report

Volkswagen AG (VLKAY): Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN): Free Stock Analysis Report

LKQ Corporation (LKQ): Free Stock Analysis Report

Original post

Zacks Investment Research