The cattle market has been overbought for the last week with futures currently trading 2.4% off recent highs made 7/28. The discount of futures to cash of late and the outlook for tight supplies in the future should keep the market bid longer term but this does not mean we cannot get a price correction short term. Outside markets such as weakness in the hog market and a correction in the equity markets could cause spillover weakness. There have been no significant fundamental changes but perceived demand concerns might contribute to selling pressure and a 5% correction is what I am targeting. October Live Cattle did close near a $6.40 discount to the cash markets as compared with the 5-yr average showing a premium of $6.40 to cash. With cash prices in Texas and Nebraska seen above even the recent highs in futures we currently do not see a substantial # of traders wanting to sell near $155/$156 but what if cash prices falter and trade sub $160? Daily stochastics are rolling over from overbought levels and futures have lost ground 3 out of the last 5 sessions. Near-term support in October is seen at $154 followed by $150 then $148.

YTD October live cattle futures have been on a one way train appreciating high/low 22.6% lifting prices to their highest level in history just 9 days ago. Picking tops is a fool’s game and while I am not convinced the bull market in heifers is over I am forecasting a correction at this time. Futures are currently challenging their 20 day MA (dark blue line) and on a settlement under that pivot point an interim top would be confirmed in my eyes. I anticipate 5% depreciation in prices with an objective at $148 in October futures. This is a 40,000 lb. contract so a move from current trade would represent a move of approximately $3,200 per futures contract. Obviously one could opt to take advantage of this trade via futures or options. A trend line that has been in place since the Spring and 38.2% Fibonacci retracement both come in at this level. Assuming we get the move lower in the coming weeks that would serve as my exit door.

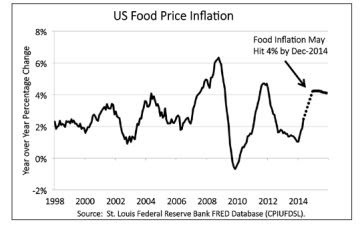

I would be remiss putting out this piece without talking about food inflation. Anyone that has gone to the super market in recent months should be aware that food prices are on the rise. As of May 2014 food price inflation was running at 2.46% (year over year) and possibly heading to 4% by late 2014 or early 2015. (See below) It is comical to me that the Fed prefers to target core inflation and strips out food and energy because we consume food and energy and their price appreciation affects us on a daily basis. Their logic is by not factoring volatile food and energy prices it lessens the chance of a head-fake in the data. Of course if we see a rise in core inflation alongside food inflation the Fed may take this into consideration and look to make a move sooner rather than later. Current market expectations are predicting a potential rate move as early as the March meeting.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI