Investing.com’s stocks of the week

Yesterday’s price action in Cattle Futures caught my eye. The October contract, which is the front month, made a new contract low and then rapidly reversed with high volume and finished much higher for the day

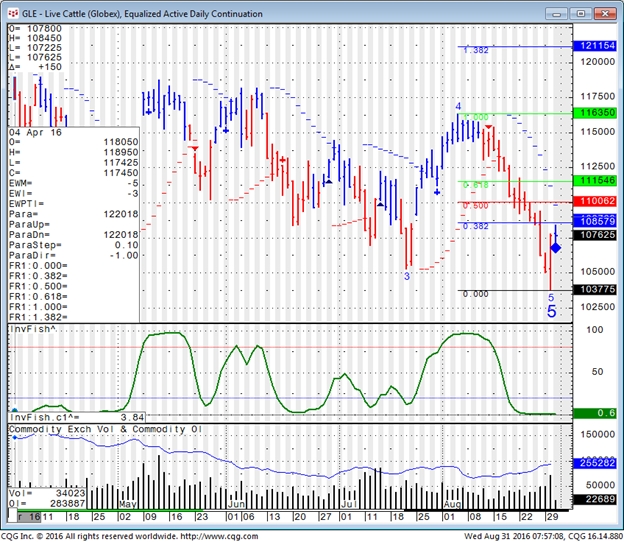

Chart technicians call this “key reversal” and you can actually see it in the daily chart below:

The chart tells me that there is a potential for the initial short covering to develop into a short term run up. The blue diamond I got as a signal suggests that as well.

On the other hand the longer term picture tells me we are still in a down trend and my read on the supply / demand situation in the cash market portrays a slightly bearish picture.

I would look for a slight pull back in prices and try to attack the long side of this market as long as we can hold the 103.775 level (August 30th low). My initial target is 110.050.

If I am right, I will need to manage my trader at that point based on many different factors. If I am “very” right, I would actually look for signs of weakness and reversal around the 111.500 level but that’s already way ahead of the game….

There are more than a few ways to go about this one. You can buy call options. You can go long futures with a stop, you can go long futures and buy a put option as a hedge and many more alternatives to attacking the same market outlook I am sharing if you agree and like it.