Last fall I spoke at an active money management conference, where I introduced about a half-a-dozen or more weekly inter-market ETF models designed to measure “risk acceptance” in equities. The subject of this post features one of the more basic models, which was partially inspired by the highly recommended “The Lawyer Trader” blog.

This particular model is named “Sensitive Issues Scoring,” or here “Little-SIS” for short (she has a big sister, after all). The idea is to construct an aggregate oscillator using various ETFs that are especially sensitive to the economy, and may therefore either lead or emphasize broader market trends. When I use the phrase, “emphasize”, I mean exaggerate in such a way that makes the signal wholly unambiguous and cross-confirmed.

Assessing Risk Acceptance

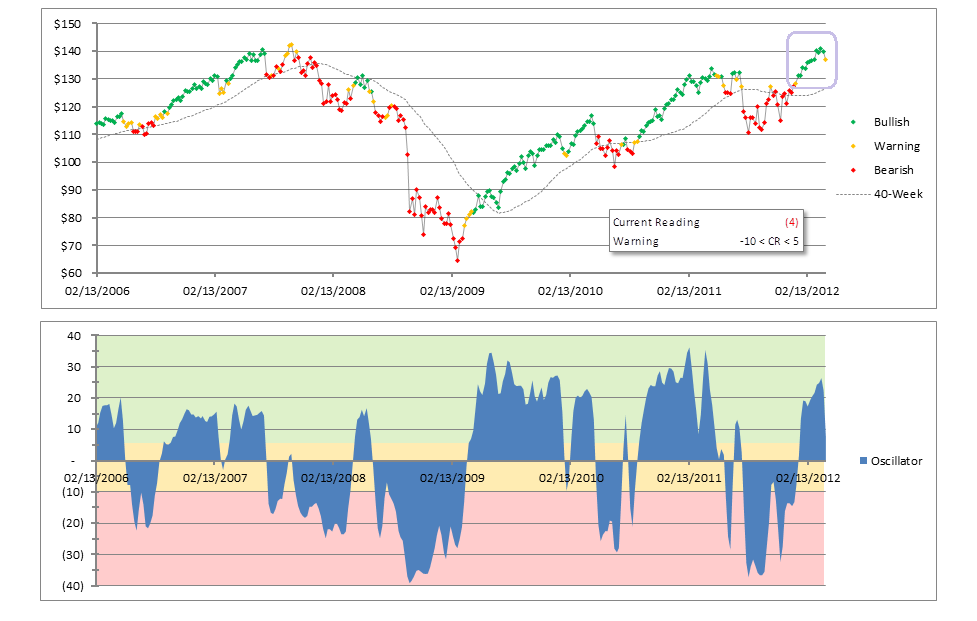

In fact, the model below uses nine diverse, economically sensitive ETFs to “paint the tape” in the top pane with three risk states, here as against the S&P 500 using the SPY ETF proxy from February 2006 to-date.

The oscillator maybe constructed using a variety of approaches, including slope scoring, relative price versus moving average positioning, and others, then summing all those ordinalized scores across the selected ETFs and setting oscillator bounds. Really, the possibilities are endless — experiment away!

Now, most of my other models are still seeing “Risk On”, even if at a moderated level, so this is really just an early heads-up. More often than not the warnings are false positives, but it’s also true that they nearly always precede full volatility events. For the bull’s sake, let’s therefore hope it’s not a canary in the coal mine this go around.

Degrees of Confidence

The way I use these types of models is as warnings to consider hedging or exposure management. What I especially like about this type of modeling approach, is that it features diverse securities over single proxies, and is multi-state rather than simply binary. In my mind this affords such models a higher degree of confidence and nuance in their output over and above more level-one type approaches, such as single period moving averages against any single given underlying.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Little-SIS Issues First Warning In Three Months

Published 04/17/2012, 03:17 AM

Updated 07/09/2023, 06:31 AM

Little-SIS Issues First Warning In Three Months

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.