A very wild week in the markets with some great strength coming in and stocks moving very swiftly to the upside after coming back from the edge.

Early Wednesday we were just about to breakdown and the move lower would have been quite large and caused the panic that makes lows but it didn’t come. Many traders stayed home due to weather that day, and that may be the only reason we held on and then ripped higher.

There were some really great trading opportunities but holding overnight is still a risk.

We did well on the downside and then on the upside.

Markets in a correction do tend to rally hard and fast to suck people in and I’m still not so sure this correction is yet complete but that doesn’t mean we can’t make some money while we wait.

Trading is all about taking the right risks at the right time and for now this market remains very risky and only for the quick traders out there.

As for gold, it’s getting very tight here and should now move anytime and it still appears to want higher.

If you took the silver long position I talked about here in last weeks letter as being a very low risk, you had a great week! Congrats!

Gold ended the week up 1.49%. We are very near a move here as this triangle pattern is getting very, very tight.

There is a saying that little bars, or tight trading, leads to big bars and that is what we are setting up well for here with gold.

The buy point here is a move above its 100 day moving average now at $1,271.90 which also coincides with its large downtrend line.

This is a great setup here but I do have a sneaking suspicion the breakout will come Sunday night in overseas trading while I’m sound asleep.

These trades are very bullish and only add one more arrow to the bullish quiver.

Silver moved very well this past week and ended up 3.91%.

Last weekend I talked here about the very low risk entry point at $19. That level worked perfectly as it should have and now silver is just waiting for gold to breakout before it makes a run out of this large flat base to the $21.50 level.

Just great action here all in all.

Platinum was flat for the week only gaining 0.07%.

Platinum has a little wedge here which points to a continuation of this move lower.

$1,340 then $1,320 are support levels but while this does look like it wants lower, if gold breaks out higher soon then platinum should follow.

The buy point here would be a break above $1,400.

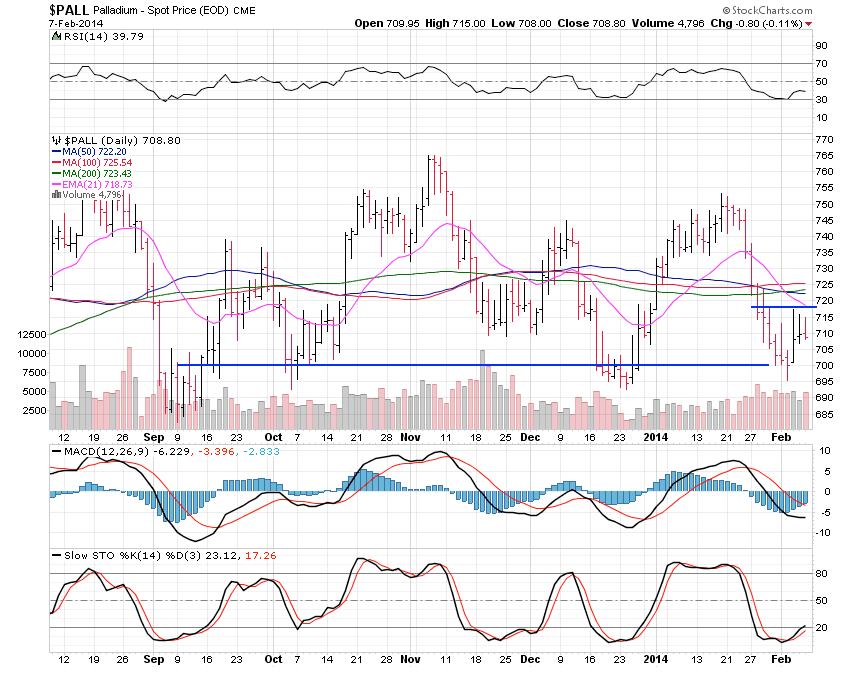

Palladium moved up 0.80% after holding the $700 support level well.

Now we have a great little U pattern which so often signifies a low and gives a great buy point.

$718 or $719 could be bought here and doubly so if gold breaks higher now.

All in all, the precious metals are really shaping up to move right now and gold will lead.

I am looking at a few ways to play this gold breakout now and also keeping a keen eye on markets the stocks who are leading us out of this correction since they will be huge winners in the weeks and months ahead.

It looks like 2014 is shaping up to be another really spectacular and special year even though its started out kind of mediocre.