Near the extinct volcano known as Monte Pissis, high in the Andes on the Chile-Argentina border, the air is thin and animal life scarce. It’s also a prime location for lithium, the silvery-white metal used in the production of lithium-ion batteries.

According to Sam Pelaez, an analyst on our team who recently visited the deposit, the seasonal meltdown of the snowy peaks collects lithium, sodium and other minerals from the soil and underwater hot springs, all of which flows down to the flats and settles—hence the name salt flats or, in Spanish, salares. Over long periods of time, with seasonal temperature variations, the salt builds a crust on top of the “lake,” making for a stunning landscape. Under the crust are high concentrations of lithium.

To extract lithium, Sam says, brine is pumped into large evaporation ponds, resulting in a higher concentration of metals. The brine is then trucked to a facility that extracts the lithium using chemical and metallurgical processes. The lithium carbonate or lithium hydroxide is sold to battery manufacturers, including Tesla (NASDAQ:TSLA).

“It’s possibly the most remote place I’ve ever been to,” Sam says, speaking of the deposit. The 3Q Project, as it’s called, is a five-hour drive from Fiambala, the nearest township, located in Argentina’s Catamarca Province. The province, and the one neighboring it, are known not only for their lithium salt flats but also gold deposits.

The 3Q Project, developed by Toronto-based Neo Lithium, is one of the largest salares discovered in recent decades, with remarkably low impurities when compared to other lithium deposits around the world.

Neo Lithium president and CEO Waldo Perez believes the project has the potential to be considered high-grade.

“The brine found in an open reservoir has the right chemistry for low-cost evaporation process, contains potash as a valuable by-product and lithium grades are equal or superior to all other known undeveloped projects and many producing mines,” Perez says.

41 Million Electric Cars by 2040

This past January, Tesla began mass producing lithium-ion battery cells at its 1.9-million-square-foot Gigafactory in Reno, Nevada. With Panasonic’s cooperation, the company expects to produce a mind-boggling 35 gigawatts of battery power a year by 2018, or about as much as the rest of the world’s current battery capacity combined. (A gigawatt, by the way, is equal to one billion watts.)

Cofounded in 2003 by serial entrepreneur and all-around genius Elon Musk, Tesla is arguably the world’s leading company involved in the production of energy storage units. But it’s certainly not the only one.

China’s CATL, or Contemporary Amperex Technology Ltd., is quickly gaining ground and plans to surpass Tesla in terms of battery production by 2020. By that year, close to 85 percent of all lithium-ion batteries in the world will be produced in either the U.S. or China, according to Goldman Sachs), which sees the battery market climbing to $40 billion by 2025.

On a global scale, nearly 40 percent of all lithium supply is used in the production of batteries, including those that power battery electric vehicles (BEVs).

It should come as no surprise, then, that lithium demand is being driven, as it were, by BEVs, sales of which are expected to rise from 0.3 million in 2015 to 11 million by 2025, according to Morningstar. And by 2040, BEV sales could hit 41 million, representing 35 percent of all new automobile sales, according to Bloomberg New Energy Finance.

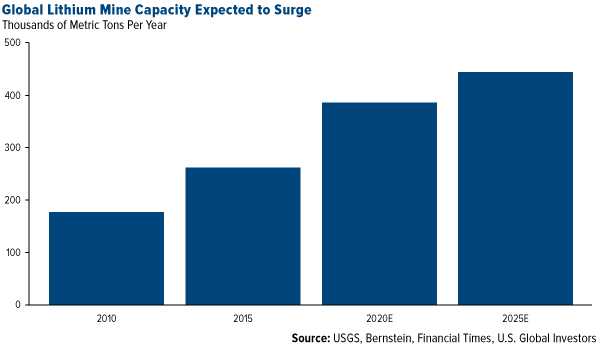

“We expect sales of electric and hybrid vehicles to push lithium demand growth 16 percent annually over the next decade, faster than almost any major commodity over the past century, from about 175,000 metric tons in 2015 to about 775,000 by 2025,” writes Morningstar analyst David Wang.

Wang continues: “Each electric vehicle uses roughly 28,000 grams of lithium in its battery, about 4,000 times as much as the seven grams used in a smartphone. Each hybrid uses roughly 1,900 grams, approximately 270 times as much as a smartphone.”

(Electric cars and hybrids also require more copper than conventional vehicles. The Tesla Model 3 uses three times as much copper wiring than a vehicle with an internal combustion engine.)

Morningstar estimates that lithium supply will struggle to keep pace with growing demand in the coming years, resulting in a 105,000-metric ton deficit by 2025. This supply-demand imbalance could raise the price of lithium significantly, “from $6,500 per metric ton currently to $10,000 by 2020,” writes Wang.

Who Are the Beneficiaries?

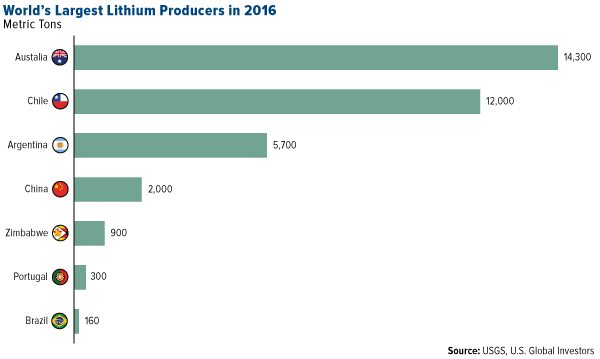

World lithium production is currently dominated by four companies: North Carolina-based Albemarle (NYSE:ALB), Philadelphia-based FMC Corporation (NYSE:FMC), Chile’s Sociedad Química y Minera and China’s Tianqi Lithium. Among these, Albemarle has the highest exposure to lithium, according to Morningstar. Just this month, the company raised its lithium demand forecast by the end of the decade, saying demand will grow by 30,000 metric tons a year, up from an earlier forecast of 20,000 metric tons.

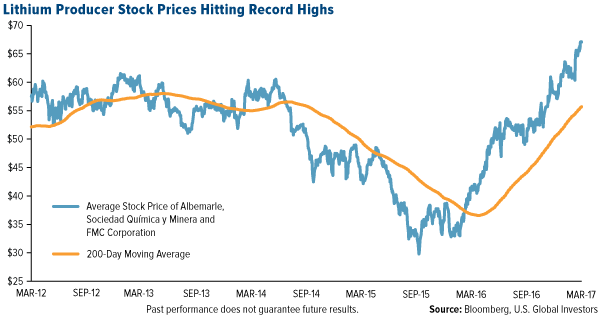

For 12 months now, lithium stocks have been on a steady uptrend, outpacing their 200-day moving average.

But China is catching up. Its greatest advantage over the U.S. is its access to lithium. The Asian country, according to the U.S. Geological Survey, is the fourth-largest producer, having mined 2,000 metric tons in 2016 alone.

According to the International Energy Agency (IEA), China already leads the world in the number of electric two-wheelers and bus fleets. Working in the market’s favor is Beijing’s recent call for automobile companies to double their battery capacity between now and 2020. BEV ownership also entitles Chinese citizens to an exemption from acquisition tax and the excise tax, worth between 35,000 and 60,000 renminbi, or between $5,000 and $9,000. (In the U.S., tax credits for purchasing a BEV vary from $2,500 to $7,500.)

Trump to Scrap Fuel Economy Standards?

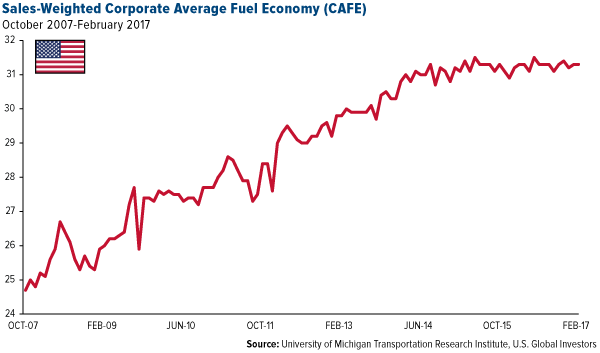

Meanwhile, President Donald Trump has ordered a review of corporate average fuel economy (CAFE) standards, which have mandated gradual increases in the fuel economy of cars and light trucks since 1975.

Average fuel economy currently stands at 31.3 miles per gallon, as of February, and will need to reach 54.5 by 2025.

Overturning CAFE standards would mean automakers could produce vehicles with a lower fuel economy, for a lot less than hybrids and BEVs. This is a threat to BEV demand—and ultimately lithium— since they’re typically more expensive, with the Tesla Model 3 starting at $35,000. However, like all new tech, prices will likely drop significantly over time. By 2022, the cost of battery-powered cars is expected to be comparable to those with an internal combustion engine.

In response to Trump’s opposition to fuel economy regulation, about 30 U.S. cities, including New York, Los Angeles and Chicago, are reportedly planning to spend as much as $10 billion on new electric vehicles for police cruisers, trash haulers, street sweepers and more. Such a move is intended to show automakers there’s demand for BEVs, which also bodes well for lithium.

Disclosure: All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.