Litecoin, the fifth largest cryptocurrency by market cap, reached its all-time high in mid-December, 2017, accompanied by most other virtual tokens, including the biggest one in the face of Bitcoin. The following crash, which erased almost 70% of Bitcoin’s market cap, wiped out over 71% of Litecoin’s capitalization after the price dropped from over $370 to less than $107 by February 6th, 2018.

Fortunately for LTC/USD bulls, the pair recovered to $253 fourteen days later, in unison with the general crypto market. As of this writing, the price is hovering around $209. In order to prepare for the market’s future intentions regarding Litecoin, we need to take a look at its price charts and see if an Elliott Wave pattern would emerge and give us a hint.

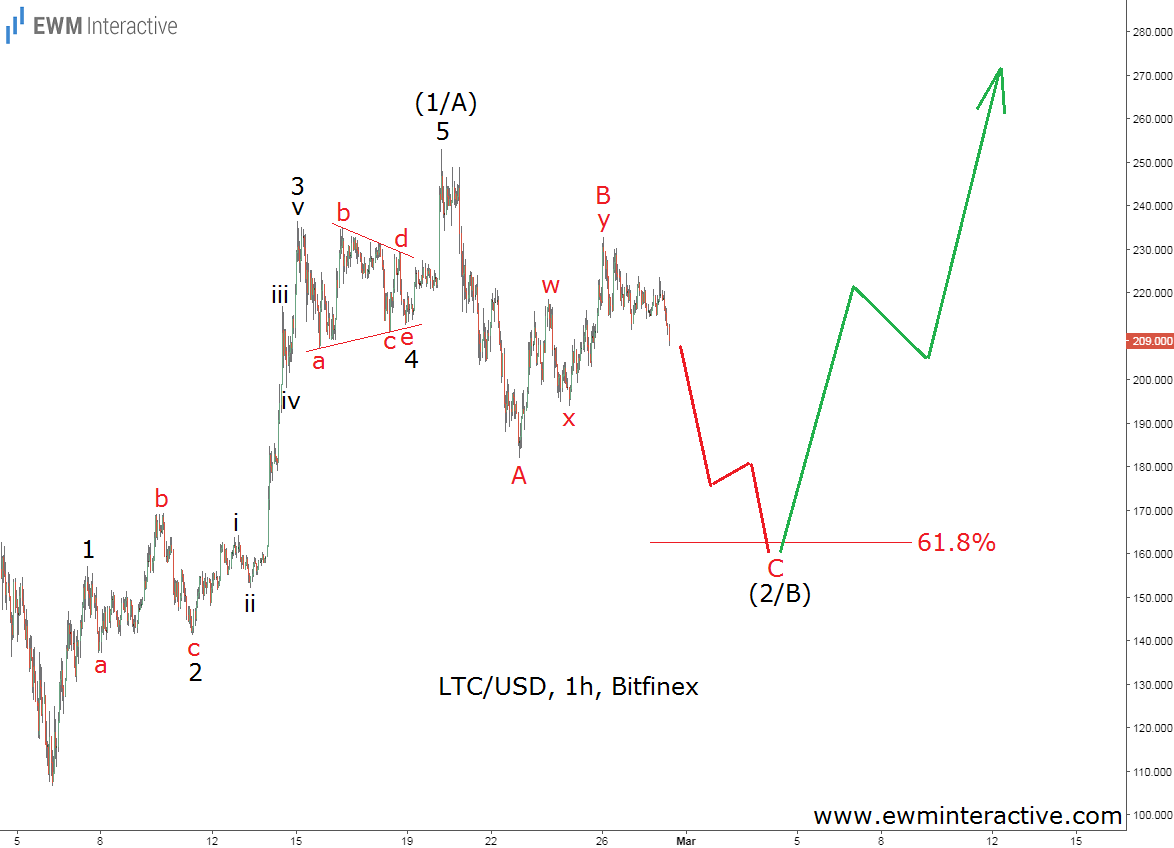

Bitfinex’s hourly chart of LTCUSD allows us to see that the rally from $106 to $253 takes the shape of a five-wave impulse, labaled 1-2-3-4-5. The sub-waves of wave 3 are also clearly visible, but in that case the market ignored the guideline of alternation since both corrective waves move sideways. Wave 2 is a running flat correction, while wave 4 is a triangle.

Nevertheless, every impulse is followed by a three-wave retracement in the opposite direction. That is what we believe has been in progress since February 20th, when Litecoin touched $253. The decline to $181 is marked as wave A, followed by a smaller three-wave advance to $233 in wave B. If this count is correct, more weakness should be expected in wave C towards the 61.8% Fibonacci level. In other words, the bears remain in charge with short-term targets between $170 and $160. Once there, the 5-3 wave cycle would be complete and the uptrend should resume. Eventually, the bulls should be able to lift the price of Litecoin above $253. As long as the starting point of the impulsive pattern at $106 holds, this is the wave count to rely on.