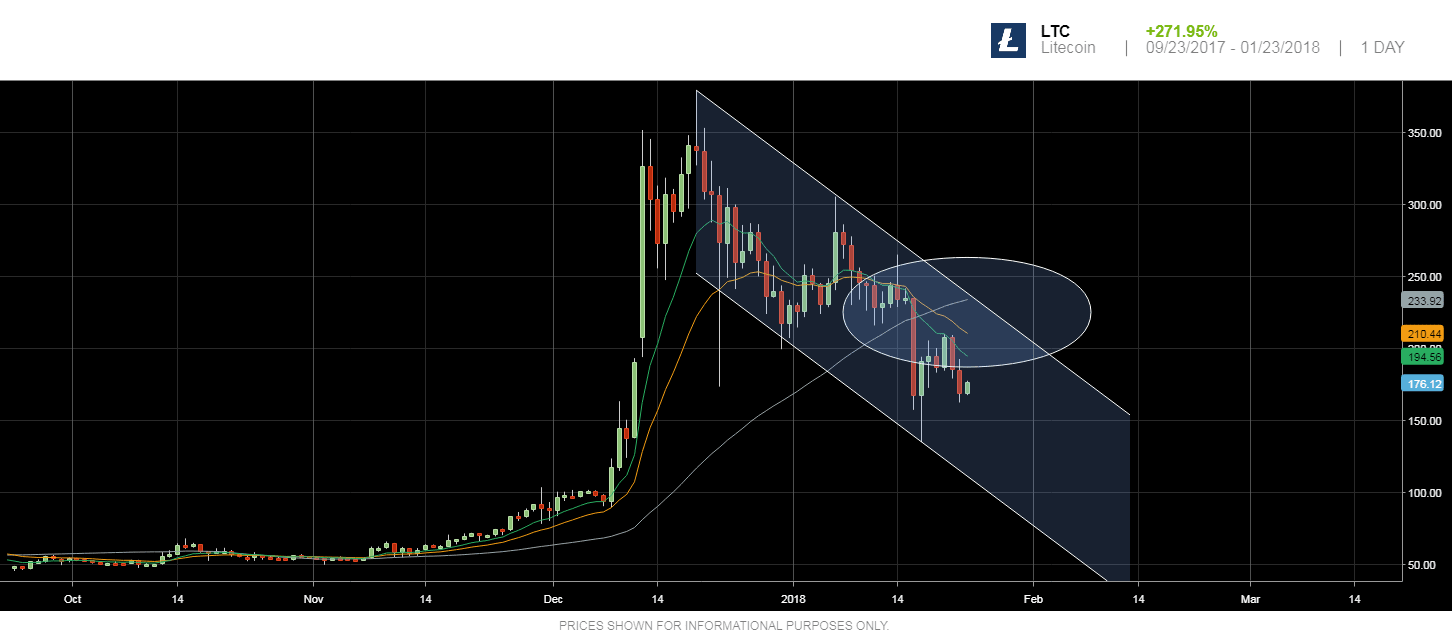

Some Bearish developments happened in LTC lately. LTC is trading under 50-day SMA which is negative. Moreover, the 20-day EMA broke below the 50-day SMA which considered a bearish crossover. LTC is also trading into a downtrend channel.

LTC has to break out many resistance levels to resume the uptrend the 20-day EMA, 50-day SMA and the resistance line of the channel. You can open long position only on a break out of the channel at $235. Conversely, if it can't succeed to break above the moving averages soon we expect a rally to $135 or even lower at $100.

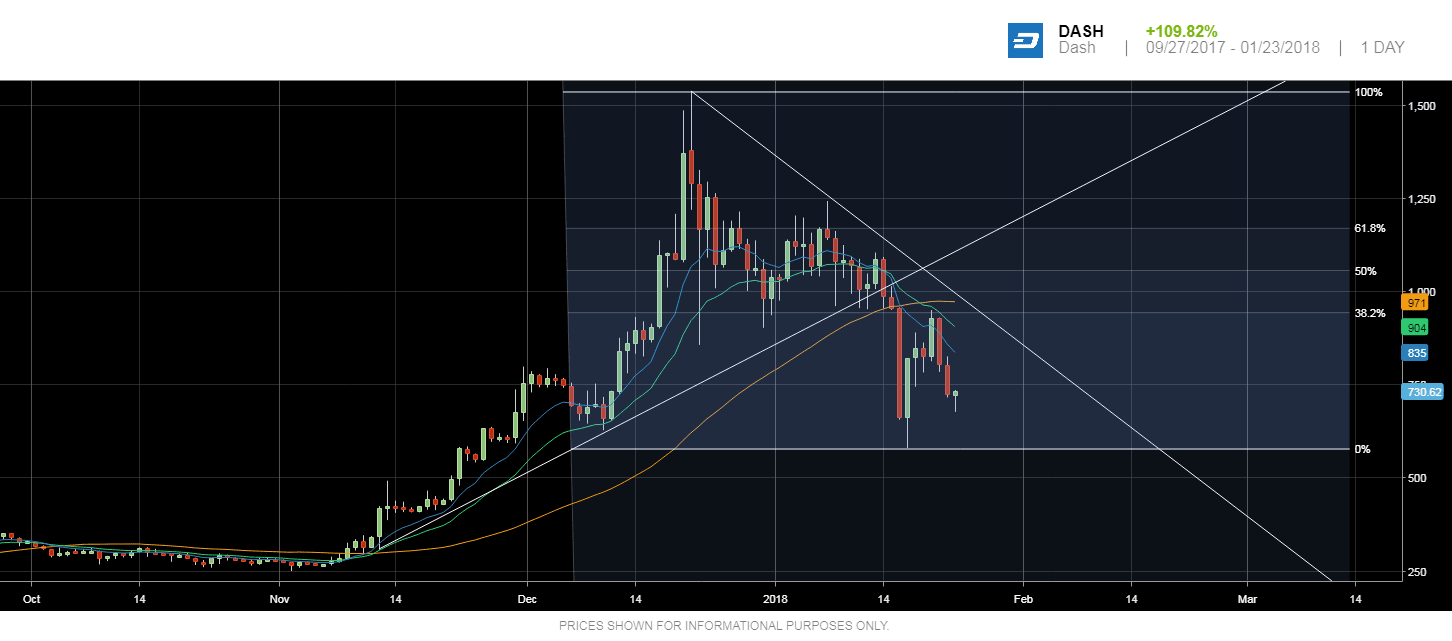

After a sharp fall that took Dash from the all-time high at $1540 to nearly $570, but we haven't seen a sharp pullback. Dash couldn't go above 38.2 percent Fibonacci retracement level on two occasions.

Additionally, Dash broke down 50-day SMA which shows weakness.

We expect 38.2 percent Fibonacci retracement level and 50-day SMA act as stiff resistance as they come nearly in the same place $950. On the other hand, any failure of breaking above these levels will take Dash to $570 thereafter to $500 level.