Allergan plc (NYSE:AGN) announced that a Texas federal district court invalidated four of the six patents covering Restasis, Allergan’s second bestselling drug. This potentially opens the doors for early generic competition. Shares of the company fell almost 3.5% in response on Monday.

The company is disappointed with the court’s ruling and is planning to appeal against it. However, if this ruling is upheld even after the appeal, it will negatively impact Restasis sales. The invalidated patents —‘111, ‘048, ‘930 and ‘191 — which are listed in the Orange Book were set to expire in Aug 27, 2024.

Restasis is approved for the treatment of chronic dry eye.

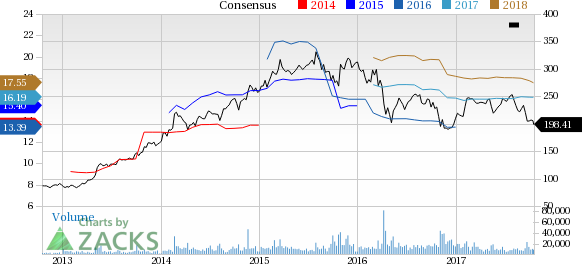

Allegan’s shares have outperformed the industry so far this year. While the company’s stock fell 5.6%, the industry was down 23.5% in that period.

In 2015, Allergan had filed patent infringement lawsuits against a group of generic drug manufacturers which include Teva Pharma (NYSE:TEVA) and Mylan (NASDAQ:MYL) among others. The companies are seeking approval for generic versions of Restasis in the United States. Meanwhile, last week, Allergan settled with InnoPharma, granting the latter the right to market generic Restasis beginning Feb 24, 2024.

Moreover, in a bid to dismiss inter partes review for Restasis, Allergan signed an agreement last month with Saint Regis Mohawk Tribe, to gain sovereign immunity. However, court litigation is out of the purview of sovereign immunity. This unconventional move by the company has been questioned by many lawmakers and was criticized by generic manufacturers. Such deals to gain sovereign immunity will make the launch of generics a lengthy and complex legal process, curbing competition.

Restasis generated $676.4 million in sales worldwide in the first the six months of 2017. The FDA’s approval to Shire PLC’s (NASDAQ:SHPG) Xiidra last year has already increased competition for the drug. Any earlier-than-expected generic entry following the invalidation of these patents will further increase competition.

Allergan carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Allergan PLC. (AGN): Free Stock Analysis Report

Shire PLC (SHPG): Free Stock Analysis Report

Teva Pharmaceutical Industries Limited (TEVA): Free Stock Analysis Report

Mylan N.V. (MYL): Free Stock Analysis Report

Original post

Zacks Investment Research