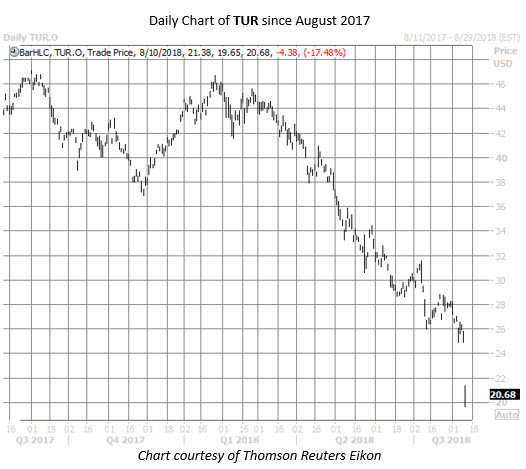

As Turkey's lira plunges to record lows against the U.S. dollar, and President Donald Trump talks of doubling tariffs on the country's steel and aluminum, the iShares MSCI Turkey (NASDAQ:TUR) is pacing for its worst day ever. The exchange-traded fund (ETF) is down 17.5% to trade at $20.68, and earlier fell as low as $19.65 -- territory not charted since the March 2009 financial crisis bottom. Against this backdrop, TUR options are flying off the shelves today.

TUR shares -- on the short-sale restricted list today -- have been deflating for most of 2018, and have now given up more than 50% year-to-date. The lira has been in a free-fall, too, despite an emergency rate hike in May by Turkey's central bank.

So far today, TUR has seen roughly 13,000 puts and 4,800 calls change hands -- 14 times the average intraday pace. Today's options volume is now on pace to hit an annual high, and top the current peak set on June 4, when about 26,000 puts and 12,000 calls were exchanged.

Most active today is the September 19 put, where several notable blocks were apparently bought to open within the first five minutes of trading. By purchasing the puts to open, the buyers expect TUR shares to breach $19 -- and extend their run to new lows -- by the close on Friday, Sept. 21, when the options expire.