Lions Gate Entertainment Corp. LGF.A just released its third quarter fiscal 2018 financial results, posting earnings of 51 cents per share and revenues of $1.14 billion. Shares are trading up 1.21% to $30.94 shortly after the report was released.

Currently, LGF is a #3 (Hold) on the Zacks Rank, and earnings estimate revisions are mixed for the next few quarters.

Lions Gate:

Beat earnings estimates. The movie studio posted adjusted basic earnings of 51 cents per share, soaring past the Zacks Consensus Estimate of 20 cents per share. Net income was $107 million.

Lions Gate notes that the company’s basic EPS include a one-time tax benefit of $165 million, which reflects the impact of the lower U.S. income tax rate under the current law.

Beat revenue estimates. The company saw revenue figures of $1.14 billion, surpassing our consensus estimate of $1.07 billion and increased 52%.

Its Media Networks segment revenues grew 6%, while Motion Picture segment revenues increased 14% thanks to strong domestic theatrical box office performance of the breakout hit Wonder and the continued strong international performances of La La Land and American Assassin.

LGF also pointed out that its results this quarter are not directly comparable to prior reporting periods because of its recent acquisition of Starz.

"With this financial strength, we're pleased to announce that our Board has approved the resumption of our quarterly cash dividend, returning value to our shareholders as we continue to grow our Company. Despite a disruptive operating environment, the quarter shows our success in creating premium content that cuts through the clutter of a crowded marketplace and our ability to supply it to a diverse array of media companies,” said CEO Jon Feltheimer.

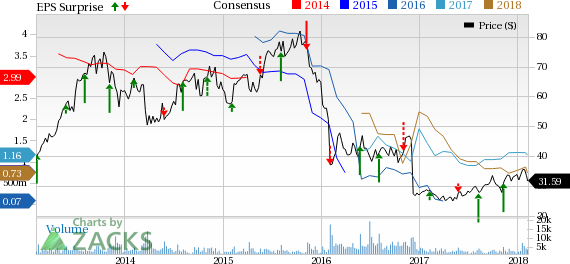

Here’s a graph that looks at Lions Gate’s price, consensus, and EPS surprise:

Lions Gate is an entertainment company with a presence in motion picture production and distribution, television programming and syndication, home entertainment, digital distribution and new channel platforms. It is engaged in the development and production of feature films, North American theatrical, home entertainment, and television distribution of feature films and worldwide licensing of distribution rights to feature films. Lions Gate Entertainment Corp. is headquartered in Vancouver, British Columbia.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think. See This Ticker Free >>

Lions Gate Entertainment Corporation (LGF.A): Free Stock Analysis Report

Original post

Zacks Investment Research