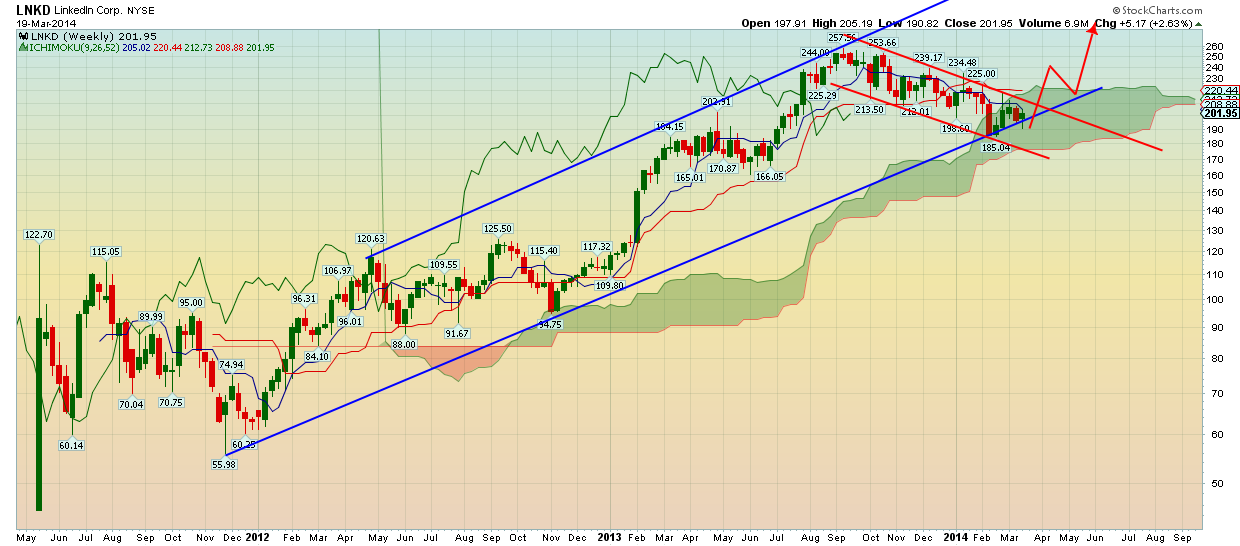

LinkedIn Corporation, (LNKD) shares have been slowly, but steadily moved lower from past September highs of $257 towards $185.

The declining trend Linkedin is currently in has a corrective pattern and no clear impulsive form. The overlapping wave structure from its highs suggests that when this corrective move ends, we should anticipate a new upward wave that will most probably will give new highs above 257. Intermediate term trend is down as prices remain inside the downward sloping channel as shown in the chart below.

Prices continue to make lower lows and lower highs and on a daily basis the Ichimoku cloud is still above the current market price. However, there is a chance that the low at 185 was THE low and a new upward move has already started and trend has already reversed. Confirmation will come if two conditions are met. First, we will need to see an impulsive move upwards from recent lows. Secondly we would want to see 217-220 taken out. Unless we break above this downward sloping channel and cancel the sequence of lower lows and lower highs, I’m unsure if the upward move I expect has started.

In the weekly chart shown below, we show why it is very possible to have seen the lows. However, as long as we do not break above 220$ we could even witness a false break down towards 185-180$ for a double bottom. The weekly Ichimoku cloud is key support for the up trend that comes from 55$. My view is bullish as long as we break out of the channel we are currently in. If we break out of this channel, I expect the share price to make a new higher high above 257$ and possibly we will see the 300$ level being reached.

LNKD is above key support area now and we could soon start a new upward move if not already underway towards 300$. As always, thank you for taking the time to read my new post.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.