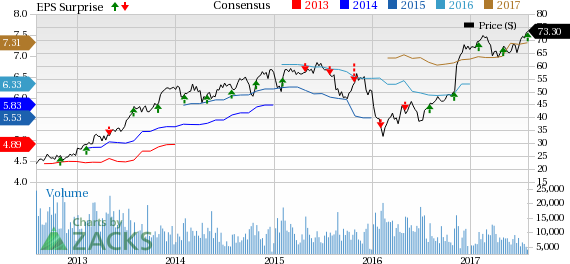

Lincoln National Corporation’s (NYSE:LNC) second-quarter 2017 operating net income of $1.85 per share surpassed the Zacks Consensus Estimate by nearly 7%. Also, the bottom line increased about 19% year over year on the back of higher revenues.

Lincoln National’s operating revenues grew 6.9% year over year to $3.577 billion on higher premiums, fee income, net investment income as well as other income. Revenues missed the Zacks Consensus Estimate of $3.606 billion.

Total expenses increased 5% to $3.0 billion year over year mainly, thanks to higher interest credited, benefits, strategic digitization expense commission and other expenses.

Higher sales resulting in higher returns along with controlled expenses and flexible capital management has enabled the company to attain financial stability.

Quarterly Segment Details

Operating income in each segment has been reportedly higher compared to the prior-year quarter

Annuities

Operating income increased 6.8% year over year to $251 million compared with $235 million due to higher fees income and growth in average account value.

Total annuity deposits fell 6% year over year attributable to decline in fixed annuity deposits.

Variable annuity sales were up 11% sequentially to $1.6 billion.

Retirement Plan Services

Operating income increased 19.4% year over year to $37 million driven by higher fee and spread income.

Total deposits grew 19% year over year to $2 billion due to strong first-year sales and persistent growth in recurring deposits.

Life Insurance

Operating income grew 10.8% to $133 million from the year-ago quarter due to in-force growth and higher spread income. Life insurance in-force improved 4% year over year to $705 billion. Total Life insurance sales increased 14% year over year to $197 million.

Group Protection

Operating income surged 133.3% from the year-ago quarter to $35 million. The upside was driven by an increase in premiums and slightly higher non-medical loss ratio. Sales in this segment increased 24% year over year to $88 million.

Other Operations

The company incurred a loss of $37 million wider than the year-ago quarter figure of $28 million owing to an after-tax expense of $9 million pertaining to a strategic digitization initiative.

Financial Update

As of Jun 30, 2017, Lincoln National’s book value per share, excluding accumulated other comprehensive income, climbed 9% year over year to $59.78 per share.

Operating return on equity, excluding accumulated other comprehensive income, expanded 100 bps year over year to 15.3%.

The company ended the quarter with long-term debt of $5.3 billion, down 6.1% year over year.

Capital Deployment

Total capital returned to shareholders was $265 million in the second quarter. This included $65 million in dividends.

During the quarter, the company repurchased $200 million worth shares.

Zacks Rank

Lincoln National carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Insurers

Among other players from the insurance industry that have reported their second-quarter earnings so far, the bottom line of Brown & Brown, Inc. (NYSE:BRO) and Fidelity National Financial, Inc. (NYSE:FNF) have topped their respective Zacks Consensus Estimates, while The Progressive Corporation (NYSE:PGR) lagged the same.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Brown & Brown, Inc. (BRO): Free Stock Analysis Report

Lincoln National Corporation (LNC): Free Stock Analysis Report

Progressive Corporation (The) (PGR): Free Stock Analysis Report

Fidelity National Financial, Inc. (FNF): Free Stock Analysis Report

Original post