Lincare Holdings Inc. (LNCR) is a provider of oxygen, respiratory and other chronic therapy services to patients in the home. The Company’s customers suffer from chronic obstructive pulmonary disease (COPD), such as emphysema, chronic bronchitis or asthma, and require supplemental oxygen, respiratory and other chronic therapy services.

ANALYSIS

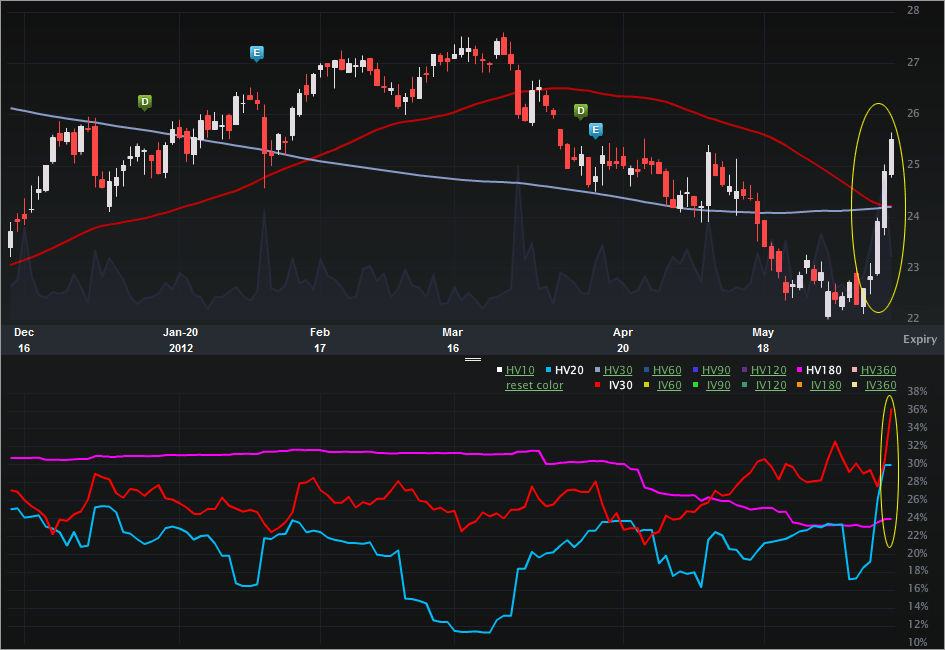

This is a stock and vol note on a company that's been spiking up recently with vol abruptly moving in the same direction. Let's start with the Charts Tab (six months), below. The top portion is the stock price, the bottom is the vol (IV30™ - red vs HV20™ - blue vs HV180™ - pink).

On the stock side, we can see that from late Mar to early Jun, LNCR stock dipped ~20%. But, it's the recent move that caught my attention. The weird thing is, I have no idea why it's popping.

On the vol side, we can see how the implied has risen with the stock, moving from 27.58% (6-12-2012) to now over 36%. That's a 32% increase in two days.

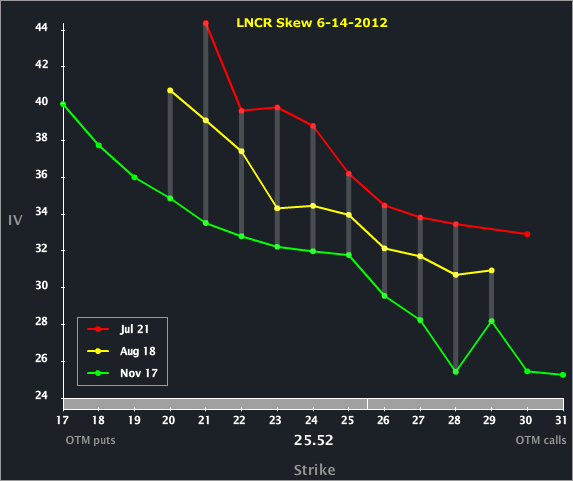

Let's turn to the Skew Tab to examine the month-to-month and line-by-line vols.

There's a beautiful back to front monotonic vol increase in the term structure, while the vols within each month have maintained their "normal" shape. The elevated vol from the front to the back reflects the risk embedded in earnings, which are likely due out just before Jul expo (but that's just a personal projection based on the last two Jul earnings dates).

SUMMARY

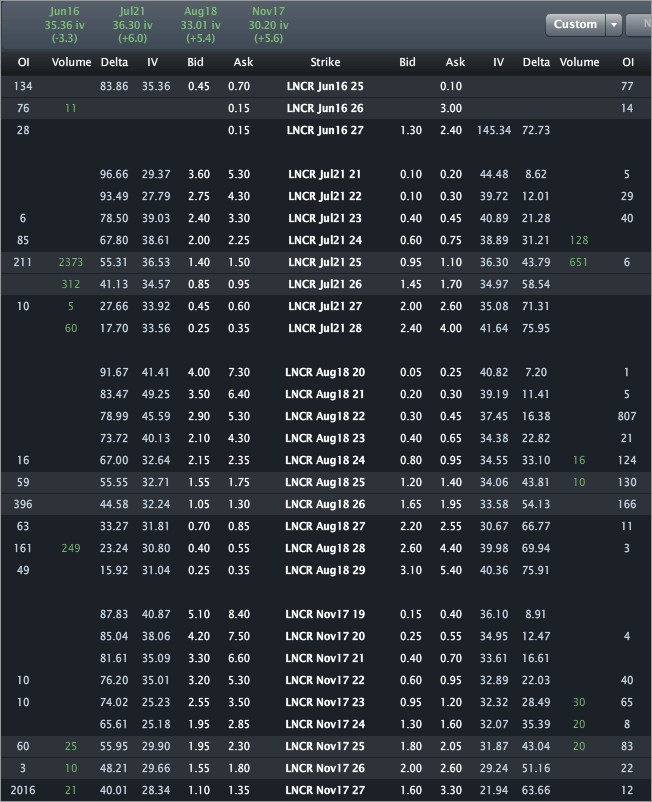

Finally, let's turn to the Options Tab for completeness.

Across the top, we can see the vol by expiry: 36.30%, 33.01% and 30.20%, respectively for Jul, Aug and Nov. I also note the trading today, the Jul 25 calls have traded 2,373x on just 211 OI. Those trades look like substantially purchases, with the price rising from $1.10 up to $1.30 over a half an hour period near the open.

I do also note that the stock volume is over 1.1 million shares against a daily average of just 806,584 shares, but, I don't see those calls trading with stock (at least not in an obvious way). In English, these look to be naked call purchases.

DISCLAIMER: This is trade analysis, not a recommendation

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Lincare Holdings: Stock And Vol Rising Abruptly, Calls Trade

Published 06/16/2012, 03:45 AM

Updated 07/09/2023, 06:31 AM

Lincare Holdings: Stock And Vol Rising Abruptly, Calls Trade

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.