The world is clearly reaching many limits. This graphic below shows how I see man interacting with natural systems, back before man discovered fire and back before man became intelligent enough to kill off whole species.

Figure 1. My view of man’s relationship to natural systems, in the beginning.

In these earliest days, human systems were a part of the natural system. Humans behaved like other animals, and fit easily into the natural order. There weren’t many humans–probably under 100,000 total in the whole world.

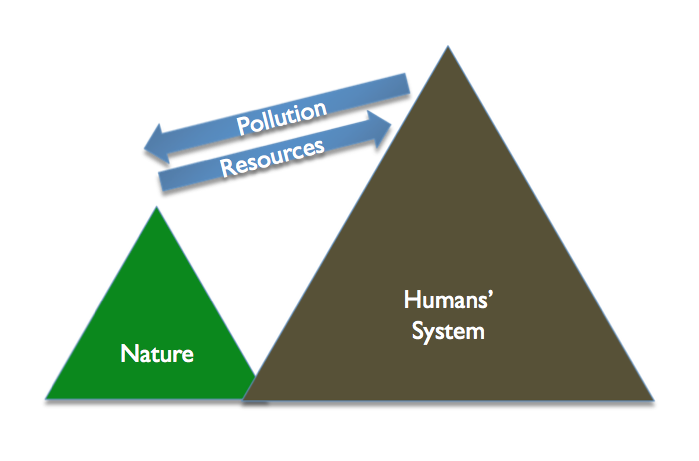

This is the way I see man’s systems interacting with the natural system now:

Figure 2.My representation of relationship of systems created by humans to the natural system, at the present time.

In my illustration, human systems are sufficiently interrelated that they combine to form one single interrelated “humans’ system”. This system draws its power from the natural system. It also puts its waste products back into the natural system. Because of entropy, we know that everything we create eventually ends up as waste products. In order to keep the humans’ system going, we need to keep adding new energy to the system, partly to offset entropy and partly to support the growing world population.

What limits are the human and natural systems reaching now?

Oil Limits

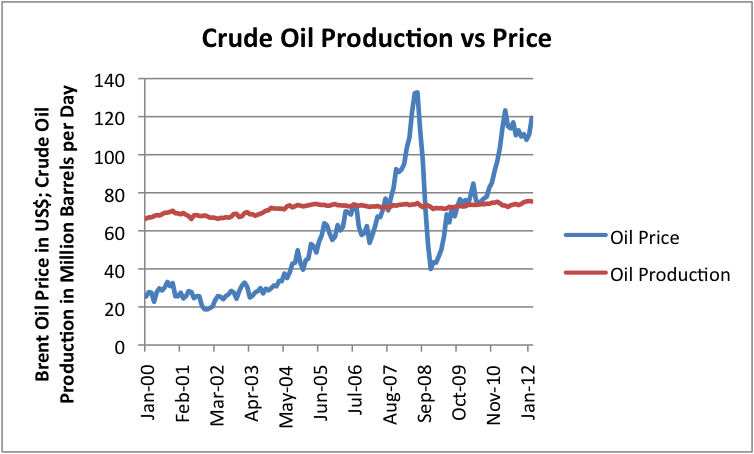

According to EIA data, crude oil production in 2005 averaged 73.6 million barrels a day. It has grown very little since then. Crude oil production for 2011 averaged 74.0 million barrels a day. In the first two months of 2012, crude oil production was higher yet, averaging 75.6 million barrels a day.

Figure 3. Crude oil production vs Brent oil spot price, in US $, based on EIA data.

Even with the higher production in 2012, and with growing “other liquids” production (not shown), crude oil production has not been sufficient to bring oil prices back to the $60 a barrel or less range that we were comfortable with prior to 2006.

The Wall Street Journal recently reported, Oil Price Likely to Stay Buoyed by Marginal Costs. Thus, part of the limit we are reaching is that the cheap-to-produce oil has mostly been produced. No matter how much oil is produced, it is hard for the price to drop very much. According to the article, Bernstein Research estimates that the marginal cost of production was $92.26 a barrel for the 50 largest oil and gas companies in 2011, and will exceed $100 barrel in 2012. These high oil prices put strains on the economies of oil-importing nations.

Debt Ratios

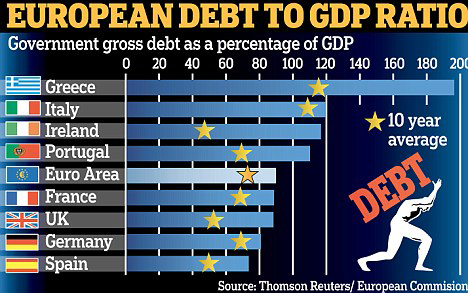

Clearly debt ratios are a problem for many countries.

Figure 4. European debt to GDP ratios, from This in MONEY.co.uk.

Debt ratios tend to rise, as oil importing countries have more and more problems with high oil prices. People who are laid off from work don’t pay taxes; instead, they expect to get payments from government-funded programs. The combination tends to force debt levels of governments higher.

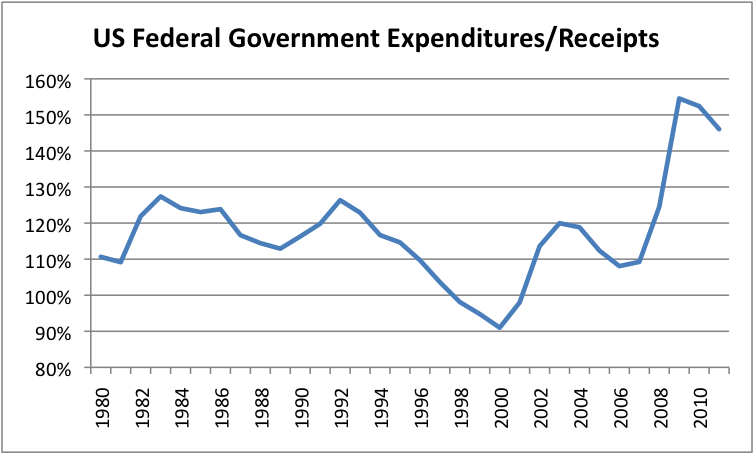

The US government is paying out a great deal more than it is taking in. Based on Bureau of Economic Analysis data, the US government ratio of outgo to income was 146% in calendar year 2011.

Figure 5. US government expenditures divided by receipts, based on US Bureau of Economic Analysis data.

This wide gulf between income and expenditures is being used to try to prevent recession in the United States. Legislation which was passed last year requires that this gap be fixed, starting the beginning of 2013. The Congressional Budget Office is now warning that the United States is likely to enter recession when this happens.

Over-Promised Social Security and Other Benefit Programs

If a person looks at the information underlying the US budget for 2013 (see page 208), it becomes clear that the big gap between income and outgo is in “Mandatory Programs,” in other words, Social Security, Medicare, Unemployment, and Other Mandatory Programs. It is hard to see any way the spending gap can be cut without cutting these programs.

The reason why this issue has been overlooked is because Social Security is supposedly funded on an accrual basis in accounting for the program, but in fact the funding goes through the US budget program, which is on a cash basis. While some funds were collected in advance to smooth out the baby boom bulge, these funds have already been spent. Thus, the huge payouts as the baby boomers retire look at though they will directly affect the US budget. (This issue deserves a separate post.)

Europe can be expected to have even more problems with mandatory programs than the United States because their programs have generally been more generous. Europe also has a lower birth rate, and the benefits for the old are paid by the young. If there are not enough young people, the system doesn’t work.

Low Interest Rates

Artificially low interest rates are one way of making borrowing more attractive, so that businesses will take the opportunity to expand and individuals will be able to purchase homes and cars. Low interest rates also make the load of governmental debt more bearable. But at this point, interest rates are about as low as they can go–the only direction they can go is up from here.

One problem with artificially low interest rates is that they make it almost impossible for pension plans to make good on their promises (unless they are mostly invested in stocks, and the stocks miraculously go up). The US government guarantees pensions plans up to certain limits through the Federal Pension Guarantee Corporation. This program doesn’t have much in the way of real funds behind it–if there are widespread defaults, somehow enough funds must be provided through “printing money” or higher taxes.

Fresh Water Shortages

Fresh water shortages are a problem in many parts of the globe. The World Bank issued a report on the subject saying, “In 1997 only 47 countries borrowed for water [projects], but by 2007 there were 79 borrowers, and lending for water had increased by over 50 percent.” Besides drinking and sanitation, water is needed for irrigation and for the cooling of electrical power plants. While it is possible to convert salt water to fresh, the cost is very high. Thus, what looks like a physical problem (a shortage of water) can be “fixed,” but through an approach that affects the financial system, and uses more energy supplies.

Food Supplies That Can’t Keep Expanding

The green revolution allowed agricultural yields to increase in the 1940s through 1960s, through greater use of fertilizer and irrigation, and the development of disease resistant types of seeds, but we don’t have any follow-on major improvements now. In fact, problems with high salt levels and declining water tables where irrigation has been used make it clear that expansion of irrigation cannot continue indefinitely. Sandra Postel in “Piller of Sand: Can the Irrigation Miracle Last?” writes, “The overriding lesson of history is that most irrigation-based civilizations fail.”

Apart from difficulties in raising per-acre yields, there is also competition for land from rising biofuel production. To the extent that food shortages arise, prices can be expected to be higher, and the poor will face more difficulty in getting an adequate diet.

Pollution

Pollution occurs in many forms and in many ways. The best-known is excessive carbon dioxide, which leads to ocean acidification and climate change. There are clearly many, many kinds of pollution, since everything that is made degrades with time, becoming pollution of sorts. Once concern is that much pollution may be hidden. A recent article in Science Daily reports, Today’s Environment Influences Behavior Generations Later: Chemical Exposure Raises Descendants’ Sensitivity to Stress. This is truly disturbing news, since it would appear that conditions of our children (autism, ADHD, weight gain) might be influenced by chemicals that we or our mothers were exposed to.

Climate Change

The activities of humans have been affecting the climate for many years, since humans started cutting down and burning forests to meet their own needs, thousands of years ago. The changes we are now seeing (higher carbon dioxide levels and ocean acidification) parallel some of those that took place in the Permian extinction 252 million years ago. We don’t know exactly how things will develop from this time forward, but climate models give one indication.

Many Other Limits

This list is far too short. A person could argue that population is now reaching a limit. The concentration of nearly all ores is becoming lower and lower. Ocean acidification and overfishing are problems by themselves. Soil is eroding at higher than the rate that new soil is being formed. Loss of humus and loss of soil nutrients are issues as well.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Limits We Are Reaching – Oil, Debt, And Others

Published 05/24/2012, 03:07 AM

Updated 07/09/2023, 06:31 AM

Limits We Are Reaching – Oil, Debt, And Others

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.