Eli Lilly and Company (NYSE:LLY) and partner Incyte Corporation (NASDAQ:INCY) announced that its pipeline candidate, baricitinib, met the primary endpoint in a phase II study in patients with moderate-to-severe atopic dermatitis (AD), a type of eczema.

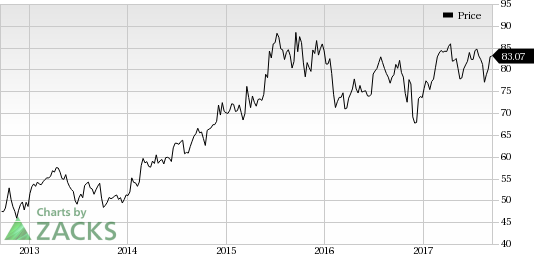

So far this year, Lilly’s shares have underperformed the industry. While, the stock has been up 12.9%, the industry gained 17%.

Notably, the results showed that after 16 weeks of treatment, 61% of patients treated with baricitinib (4 mg) in plus topical corticosteroid (TCS) achieved a 50% or greater improvement in the signs and symptoms of AD versus 37% in patients treated with TCS alone. Thereby, suggesting that baricitinib may have the potential to become an oral treatment option for patients suffering from atopic dermatitis who are unable to achieve adequate control with topical steroids.

However, in patients treated with the 2 mg dose group of baricitinib in combination with TCS, the primary endpoint was not statistically different compared to treatment with TCS alone. At four weeks of treatment, 68% of patients treated with baricitinib (4-mg) plus TCS combination and 62% of patients treated with baricitinib (2-mg )plus TCS combination witnessed an improvement in the signs and symptoms of AD compared to 16% of patients in TCS alone.

Therefore, based on the phase II results, Lilly and Incyte plan to initiate a phase III study for atopic dermatitis later this year.

Baricitinib, a once-daily oral medication, is already marketed in the EU by the trade name of Olumiant for the treatment of rheumatoid arthritis (RA).

We remind the investors that in the United States the FDA had issued a complete response letter (CRL) for baricitinib’s new drug application (NDA) for rheumatoid arthritis in April. In fact, the FDA had asked for additional clinical data to determine the most appropriate doses as well as to further characterize safety concerns across treatment arms.

In July, Lilly had declared that the NDA resubmission for baricitinib will not occur in 2017 and will be delayed by a minimum of 18 months.

But, in August, Lilly and Incyte announced that they will re-submit the NDA for baricitinib much faster than previously expected. To this end, the NDA is expected to be re-submitted in January, 2018.

Consequently, the company expects the revised submission, which will include new safety and efficacy data, to be classified by the FDA as a Class II resubmission. A decision from the FDA is therefore expected in six months. Importantly, a new clinical study will not be required.

Markedly, Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN) and partner Sanofi’s (NYSE:SNY) Dupixent Injection was recently launched in the United States for the treatment of adults with moderate-to-severe AD in March, 2017.. Currently, the drug is under review in the EU for the same indication.

Zacks Rank

Lilly carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy)stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Sanofi (PA:SASY) (SNY): Free Stock Analysis Report

Eli Lilly and Company (LLY): Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

Incyte Corporation (INCY): Free Stock Analysis Report

Original post

Zacks Investment Research