The week ended on an encouraging note for bullion investors, but can we trust this rally? Only with caution.

Our hunch is that it was a false start and that precious-metal futures and mining stocks will re-test their recent lows.This puts in doubt a profitable long position we’d recommended in GDXJ, the Junior Gold Miner ETF. Our suggested entry point at 23.93 was hit on Thursday, three cents from the low. The number is a “Hidden Pivot support” that we’d disseminated when GDXJ was trading above $26.

We’d like to think the trade will work out beautifully, meaning an eventual doubler to $50 a share. Even so, we’ve already taken a precautionary step by closing out half of the initial position on the very small paper gain that existed prior to Friday’s rally.

Although we’ve characterized our short-term bearish outlook as a “hunch,” it is buttressed by technical reasoning. What concerns us most is the heavy look of bullion-sector charts even after Friday’s rally.

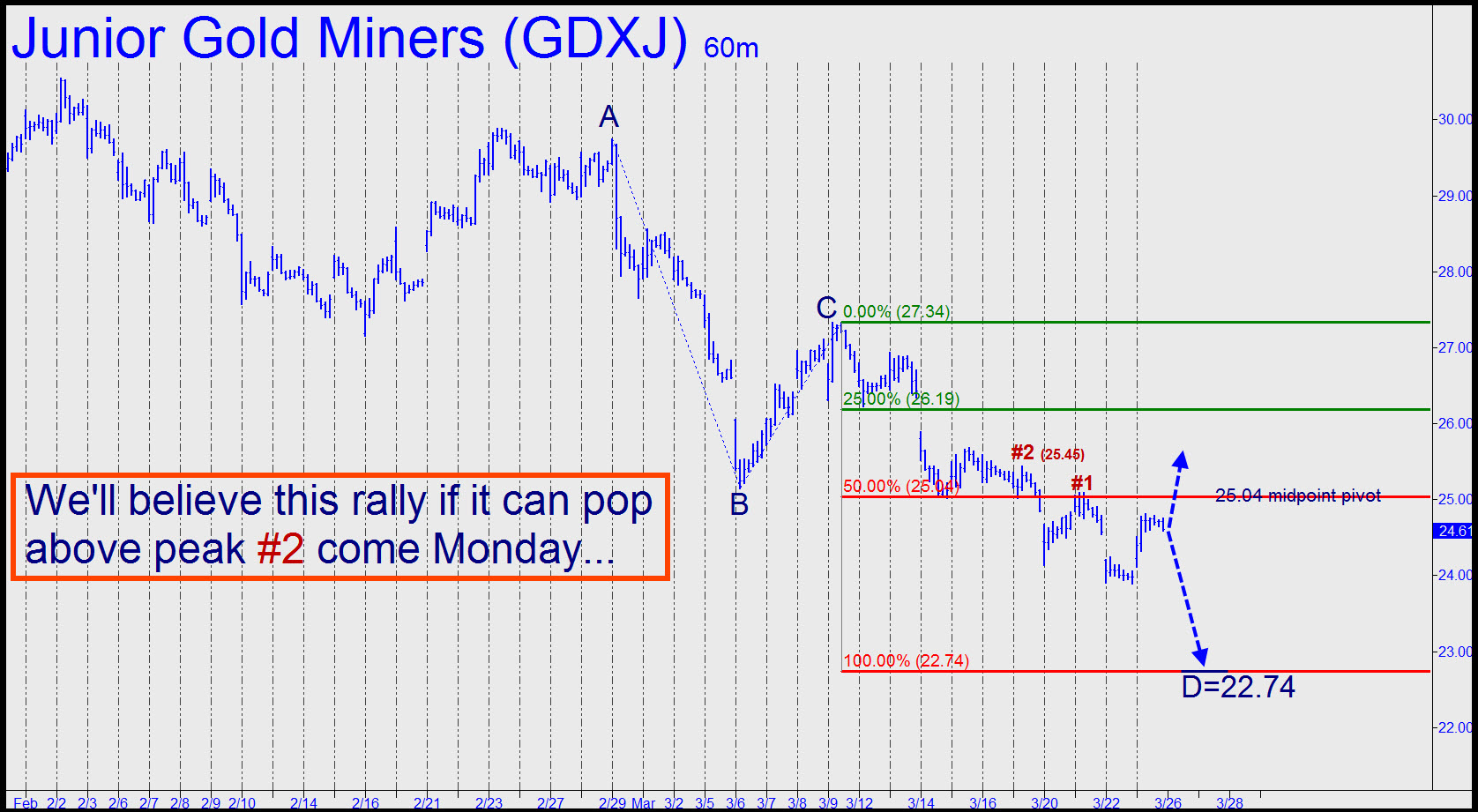

Indeed, there is such clarity in the larger, downtrending patterns on these charts that their respective downside targets look almost magnetic.You can see this in the GDXJ chart above – to sense the earnestness of the selling. The ABC price points established a bearish Hidden Pivot target at 22.74 that lies $1.16 beneath the low where we advised to get on board. Notice as well that the upper red line – what we call a “midpoint support” – appears to have mutated into resistance.

Now, if this were a stock that we love to hate - Goldman Sachs (GS) springs to mind - we’d probably tell readers to reverse their long positions and go short near the 25.04 midpoint. But because this is a gold-mining stock, we’re inclined to give it the benefit of the doubt. Even then, however, we have our rules. In this case, we’ll need to see the creation of a bullish “impulse leg” on the hourly chart before we sound the all-clear. That would take an unpaused thrust above both of the labeled peaks, #1 and #2.

Meanwhile, much as we’d like to hang onto our existing long position and ride it into the blue, we wouldn’t be too terribly disappointed to have another buying opportunity down at 22.74.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Like Gold Miners? View Friday’s Gold Rally With Caution

Published 03/26/2012, 01:20 AM

Updated 07/09/2023, 06:31 AM

Like Gold Miners? View Friday’s Gold Rally With Caution

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.