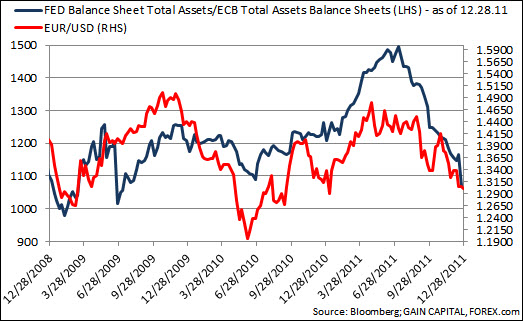

Risk assets looked set to continue higher today on the back of the successful Italian 179-day bill and 2013 bond auctions overnight. The short term ‘risk’ outlook was further supported by a completely data devoid NY session but continued upside was not to be. At around a quarter past 0900EST, G10 currencies began slipping lower versus USD on extremely light volumes just as ECB balance sheet details hit the wires - ECB says lending to banks rose €214bln to €879.1bln in week & ECB balance sheet rises to record €2.73tln.

While a rapidly increasing ECB balance sheet relative to the FED’s typically doesn’t bode well for EUR/USD as is (see chart above), EUR/USD plunged to multi-month lows around 1.2910 because of what European banks were ‘not’ doing – lending. A closer look at the ECB’s balance sheet suggested heightened potential for a debilitating liquidity crunch in Europe as the data evidenced banks depositing funds back with the ECB rather than lend to each other despite the negative real returns associated with such transactions (For more on possible negative impacts from ECB balance sheet expansion...click to view the 12.20.11; 2115ET FX VIEWS: ECB 3yr LTRO - A game changer or better short value?).

G10 FX plummeted lower versus USD:

EUR/USD upside was rejected by the 1.3075/80 holiday range highs once again, but this time the pair plunged below 1.2940/45 support (14 DEC 2011 lows) which has since acted as near term resistance. The next short term downside trigger appears to come in around the 1.2900 figure although the 2011 lows around 1.2860 may be a more meaningful support level; 1.2860 also happens to be the measured move objective for the potential H&S neckline breakout outlined in yesterday’s FX VIEWS.

EUR/JPY also plunged lower but found support around the key OCT 2011 lows near 100.80 in NY trading; immediate resistance may come in around 101.25 - broken trend-line support & possibly resistance now.

EUR breaking lower in Asia trading versus USD & JPY on what seems to be technically driven price action - EUR/USD threatening below the 1.2900 figure and EUR/JPY printing fresh decade long lows around 100.40.

GBP/USD was the worst performing G10/USD currency pair Wednesday as it crashed below converging support (200-hr sma & H&S neckline) to end down about -1.4%. The sterling found some much needed relief near medium term uptrend support (from the 6 OCT 2011 lows around 1.5275) which comes in around 1.5425/30 at the moment. Consecutive hourly closing breaks below may bring the key daily pivot around 1.5340 in view next; GBP/USD has not been rejected on each attempt to close below the aforementioned level on every single attempt since SEP 2010. Immediate resistance seems to come in around 1.5550, 61.8% retracement for the 12.14 – 12.21.11 ascent.

AUD/USD briefly traded above the 1.0200 figure in the NY a.m. which proved to be short-lived as the Aussie sharply reversed and currently trades around 1.0080. Initial resistance appears to come in around prior holiday range lows around 1.0140/50 while 1.0050 looks to be the next key downside pivot.

NZD/USD was firmly rejected on its test of the 0.7775/85 prior DEC highs and subsequently dropped a big figure to current levels around 0.7680. Immediate resistance may come in near prior holiday range lows around 0.7700, also the 200-hr sma. The 0.7625/50 pivot appears to be the next key downside trigger.

Emerging market currencies also felt the repercussions of heightened Europe debt concerns:

USD/TRY printed record highs around 1.9220 on heightened Euro-area growth fears but had already been weakening on comments by Turkey’s Basci – ‘bank would sell FX and raise corridor if flows slow’ & ‘slowing inflows also possible’ which reignited concerns of insufficient CBRT currency reserves to effectively defend extensive lira weakness on Euro-area debt contagion.

USD/ZAR moved higher from around the 8.1000 figure but found resistance around the 200-hr sma near the 8.2175 level. Above, however, may bring the downside trend-line around the 8.300 figure act as initial resistance while the 55-hr sma (around the 8.1000 figure) looks to be immediate support.

EM FX showing better resilience vs. EUR as evidenced by recent EUR/PLN and EUR/TRY price action:

Poland’s zloty and Turkey’s lira have held up relatively well versus EUR on diverging central bank policy directions.

Poland’s central bank & the state run BGK have aggressively intervened to keep its public debt below 55% of GDP in efforts to avoid compulsory fiscal tightening measures.

Turkey’s central bank has taken unorthodox monetary policy tightening to combat inflation and further lira weakness.

ECB has further room to cut while scope for traditional QE remains if Europe’s debt crisis worsens.

Top tier DM data nonexistent in Thursday’s Asia-Pacific Session although EM data evidenced EMEs trending down alongside Europe's growth outlook - S. Korea Nov. Industrial Production declined -0.4% vs. expectations for a +0.4% rise.

As was the case many times this year, Europe developments are likely to continue to drive price action. Italy’s 3 & 10yr government bond auctions (12.29.11; 0500ET) may very well be the final main event of 2011; poor outcomes would likely see EUR further banged up while strong showings may see EUR end the year with a bang. We must note, however, that extreme caution and proper risk management must be heeded for any directional FX plays on either side as thin liquidity may see increased volatility for the remainder of ’11, as was observed in Wednesday price action.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Lighter Volumes but Building Tensions Setting the Stage for M/T USD Strength? –UPDATE1

Published 12/29/2011, 08:09 AM

Updated 05/18/2020, 08:00 AM

Lighter Volumes but Building Tensions Setting the Stage for M/T USD Strength? –UPDATE1

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.