Ligand Pharmaceuticals Incorporated (NASDAQ:LGND) reported second-quarter 2017 earnings of 54 cents per share (including the after-tax impact of stock-based compensation expenses), significantly up 157.1% from the year-ago figure of 21 cents. Earnings also beat the Zacks Consensus Estimate of 25 cents per share. Lower costs and higher revenues boosted earnings in the quarter.

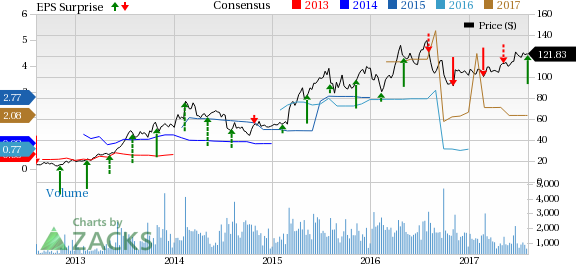

Ligand’s stock has outperformed the industry year to date. The company’s shares have rallied 25% compared with the industry’s increase of 9.7%.

Total revenue in the quarter surged 40% year over year to $28 million on the back of higher royalty revenues. Revenues also surpassed the Zacks Consensus Estimate of $24 million.

Quarterly Highlights

Royalty revenues were $14.2 million in the reported quarter, up approximately 46% year over year. Higher royalties on sales of Novartis AG’s (NYSE:NVS) Promacta and Amgen Inc.’s (NASDAQ:AMGN) Kyprolis as well as Spectrum Pharmaceuticals’ (NASDAQ:SPPI) Evomela drove this upside. Ligand licenses its platform technologies such as Captisol or OmniAb to partners for use in their proprietary programs.

Material sales also soared by 43.6% to $5.6 million owing to the favorable timing of Captisol purchases for clinical and commercial use.

License and milestone revenues were $8.2 million, thus registering a massive rise of 39.5% compared with $5.9 million in the year-ago period. This increase was courtesy the favorable timing of milestones and license fees earned.

Research & development (R&D) expenses marginally decreased by 2% to $4.8 million. General & administrative expenses reduced 9.7% year over year to $6.5 million.

Other Updates

In July, the company announced that it has entered into a commercial license and supply agreement with Amgen, granting it rights to use Captisol in the formulation of its anti-CD33 x anti-CD3 (BiTE) bi-specific antibody, AMG 330. Under the deal terms, Ligand is entitled to potential milestone payments, royalties and revenues from the future sales of AMG 330.

Also in June, Ligand announced that it has entered into a worldwide omniab platform license agreement with Surface oncology. Under this license, Surface will be able to use the OmniRat, OmniMouse and OmniFlic platforms to discover fully human mono and bi-specific antibodies.

The company is entitled to receive annual platform access payments, development and regulatory milestone payments along with tiered royalties for each product incorporating an OmniAb antibody. Surface will be responsible for all costs related to the programs.

In April, Ligand announced a commercial license and supply agreement with Marinus Pharmaceuticals, Inc., granting the latter with rights to use the company’s Captisol in the formulation of its intravenous (IV) ganaxolone. This license agreement replaces the prior research contract which allowed Marinus to evaluate ganaxolone IV with Captisol in preclinical and phase I clinical studies.

2017 Outlook

Ligand raised its 2017 revenue and earnings outlook. The company now expects earnings of approximately $2.93 per share in 2017 compared with $2.70, expected previously. The company anticipates its revenues to be $133 million for 2017 compared with $130 million, estimated previously. The core revenues are projected to comprise royalties of approximately $87 million, material sales of approximately $23 million and contract payments of at least $23 million (old guidance: $20 million).

The company is expected to receive additional contract revenues of approximately $9 million in 2017.

Zacks Rank

Ligand currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Novartis AG (NVS): Free Stock Analysis Report

Amgen Inc. (AMGN): Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND): Free Stock Analysis Report

Spectrum Pharmaceuticals, Inc. (SPPI): Free Stock Analysis Report

Original post

Zacks Investment Research