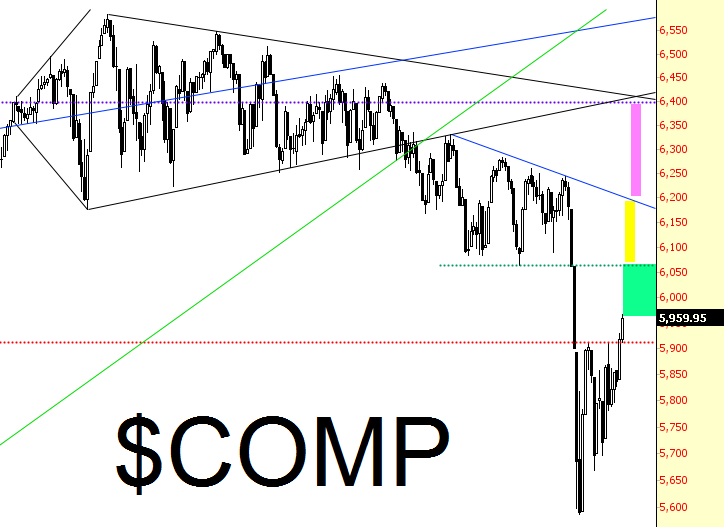

Well, I should have known it couldn’t last. The market was just way, way too fun to trade through July and August. That all stopped after August 21. That may sound odd, since the “crash” (long since forgotten) was on August 24, but the 21st is when things stopped being crystal clear and easy-to-short. It’s been a struggle since then.

Most recently, breakouts have started taking place on various asset classes. The ES sneaked above its resistance level today, and now it’s in the clear for an easy lift to 2020, 2050, or beyond.

Crude oil, too, has broken out of its (much smaller) triangle pattern. As I mentioned on my Tastytrade show yesterday, commodities might be ready to rally, and between silver, gold, and oil today, that seems to be the case so far.

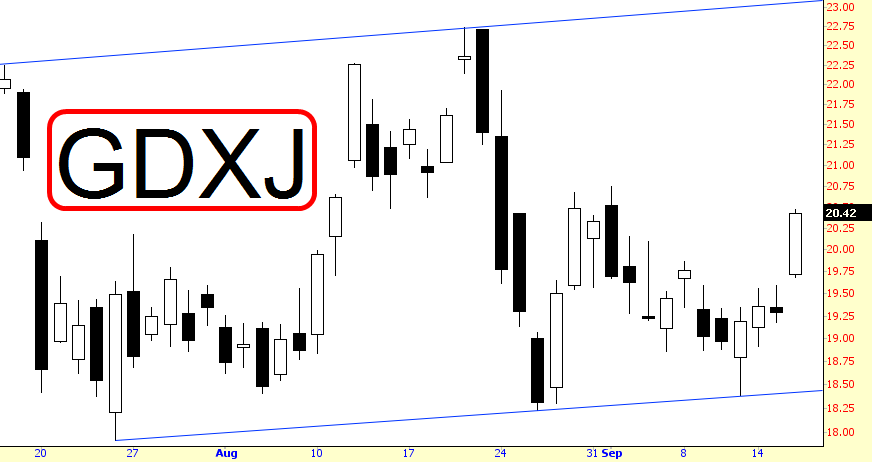

As I also mentioned on yesterday’s show, Market Vectors Junior Gold Miners UCITS A (LONDON:GDXJ) look especially attractive, and they rallied nicely today. A trip up to that upper blue trendline is completely feasible.

Of course, the event-of-the-year (supposedly) is looming, and my stomach is tied up in knots about it. Looking at the Dow Jones Composite below, the “easy” rally would be the green zone, the tougher one would be the yellow zone, and the far tougher (but, if we got there, suicide-inducing) one would be higher still.

What I’d greatly prefer, of course, is a hard reversal, but the past seven years have made the central banks of the world absolute masters at doling out disappointment to the ursine set.

At this point, the only thing that can save the bears’ collective butts is for Gartman to switch back to the bull camp. His “short stocks/long bonds” idea from late last week has been a disaster, so hopefully he’ll give up soon.