Most equity indexes are moving to lifetime highs today, so let’s look at six important cash index charts and catch up.

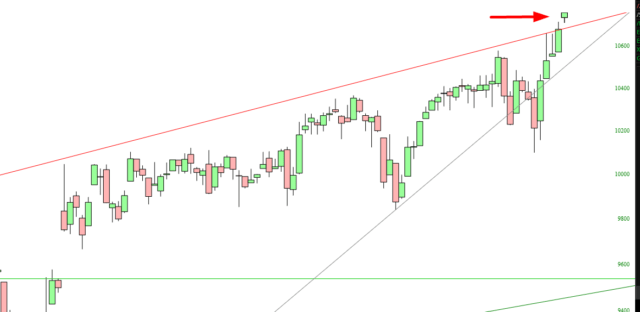

Here is the Dow Jones Composite, which has pushed above its wedge pattern. Lifetime highs are paradise for the bulls, because there is, by definition, zero overhead supply, and the psychological “virtuous cycle” kicks in (plus Record High is always a media-friendly headline).

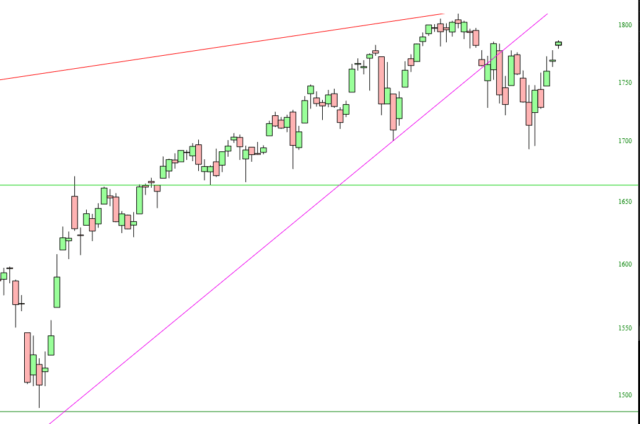

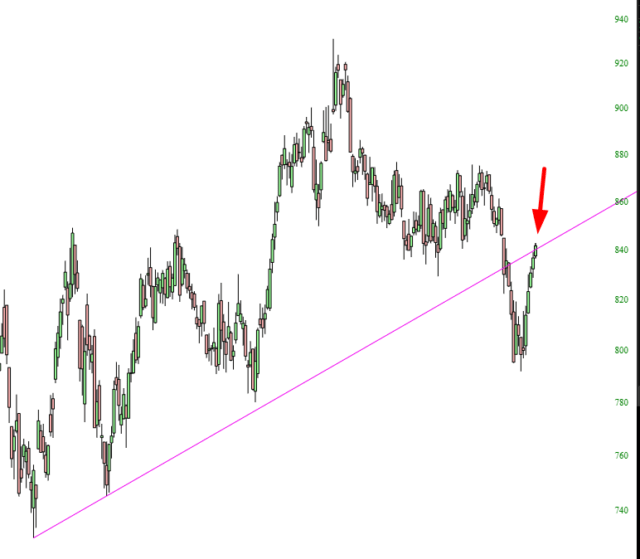

The precious metals sector is simply setting itself up for another tumble, in my opinion. The gold bugs index is coming up against its right triangle pattern, which I think will be a hard stop.

Unlike the Dow Composite (and Dow 30, for that matter) the S&P 100 isn’t quite at lifetime highs, and remains under its wedge pattern.

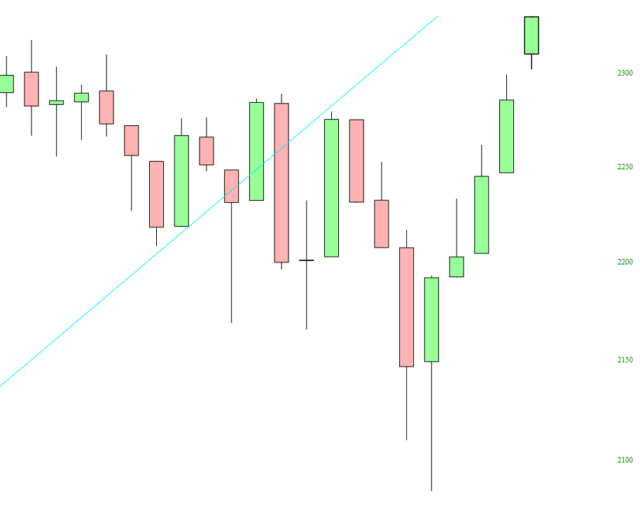

The strongest index recently is in the realm of small caps. Here is the Russell 2000, which has rocketed higher five days in a row and is at lifetime highs.

Just as I think the gold bugs are about to bounce lower, so, too, I think the Dow Utilities is biding its time before it tumbles away from its trendline.

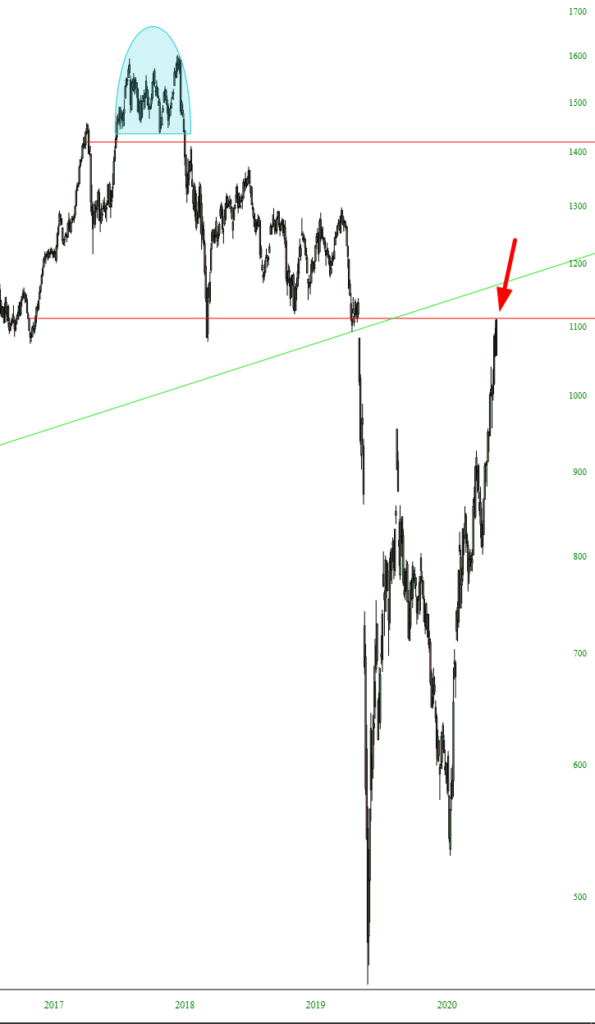

Finally, I remain committed to being an Energy Bear (again, not on the commodity, but on the companies in that sector). Here is the oil & gas index, symbol $XOI, which has made its way all the way back to its price gap.