Liberty Global Plc. (NASDAQ:LBTYA) , a leading cable MSO (multi service operator) in Europe and Latin America has entered into an agreement with ITV plc (LON:ITV). to acquire UTV Ireland TV stations from the latter through its subsidiary Virgin Media. The deal is valued at €10 million and is subject to regulatory approval from the Competition and Consumer Protection Commission and the Broadcasting Authority of Ireland as well as a separate media plurality test by the Irish Government.

UTV Ireland is a free-to-air entertainment channel currently available on Virgin Media, eir Vision, Vodafone Group (LON:VOD) Plc. (NASDAQ:VOD) , Sky and Saorview networks. Per the deal, Virgin Media will assume the existing 10-year program supply agreement between UTV Ireland and ITV Global Entertainment.

In Jun 2013, Liberty Global had acquired a 100% stake in the British cable MSO, Virgin Media. In the U.K., the merged entity poses serious competitive threat to British Sky Broadcasting Group (LON:SKYB) plc, which is partially controlled by News Corp. (NASDAQ:NWSA) . In recent years, Liberty Global has been extensively investing in the Irish market. Last year, UPC Ireland, a subsidiary of Liberty Global, acquired free-to-air Irish TV broadcaster TV3 from a private equity firm Doughty Hanson. It also purchased the Irish Wi-Fi provider Bitbuzz.

Notably, in Jul 2014, Liberty Global acquired a 6.4% stake in ITV plc. from British Sky Broadcasting Group plc. In 2015, the company further increased its stake in ITV to 9.9%. ITV is the largest commercial TV broadcaster in the U.K. with a program line-up which includes top-rated programs like “Downton Abbey” and “Got Talent”. In the U.K., ITV’s closest competitor is Channel 5, a subsidiary of Viacom Inc. (NASDAQ:VIAB) .

Liberty Global is also pursuing a systematic geographical diversification strategy and is steadily strengthening its foothold in the European pay-TV market. In Feb 2016, British telecom giant Vodafone and Liberty Global decided to merge their Dutch operations to form a 50-50 JV. The deal is currently under strict regulatory review of the European Commission.

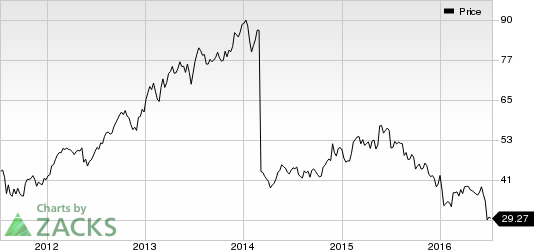

Liberty Global currently carries a Zacks Rank #4 (Sell).

LIBERTY GLBL-A (LBTYA): Free Stock Analysis Report

NEWS CORP NEW-A (NWSA): Free Stock Analysis Report

VODAFONE GP PLC (VOD): Free Stock Analysis Report

VIACOM INC-B (VIAB): Free Stock Analysis Report

Original post