Street Calls of the Week

The Investment Grade, Emerging Market Debt and High Yield Credit Strategy meetings that set the tone for LGIM’s macro and credit outlook were conducted early in the month.

Credit markets have been remarkably resilient in the face of this year’s move higher in government bond yields. After some modest widening, investment grade credit spreads ended the quarter near-or-at their tightest levels in 2021 so far, amid quarter-end buying. While the most recent jobs, CPI, and retail sales reports have all beaten expectations by a wide margin in the US, yields have moved sideways (as have real yields since the beginning of March). If the rates markets can consolidate around current levels, the macro backdrop looks relatively benign for credit. While valuations do not offer much reward for taking risk, it’s difficult to identify near-term catalysts that are likely to push spreads wider.

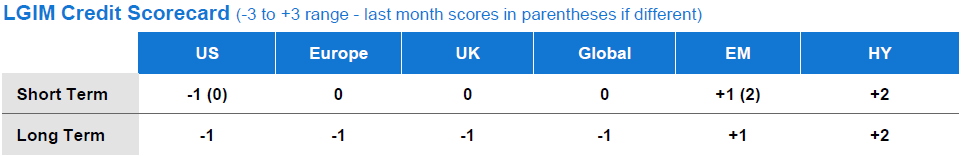

LGIM’s investment grade credit teams elected to keep their short-term and long-term scores unchanged from last month. Scores in Europe and the UK remain at neutral given there is less risk of economic overheating leading to more restrictive policy, while the US stays at -1. The high yield team retained a +2 long-term score. The emerging market team maintained their short-term score at +1, as the backdrop to emerging markets remains constructive, but longer term, the team downgraded their score to 0, as they expect a more challenging environment, with US Treasury yields to rise again and valuations to catch up.

Source: LGIM, April 2021. Please note, this is not a recommendation to buy or sell any security. This information is subject to change at any point.

Market summary

March saw President Biden sign the $1.9 trillion Covid relief bill and towards the end of the month he outlined the second stage of his fiscal plan, $2.25 trillion spending on infrastructure, funded by corporate tax hikes. The market reaction has focused more on the spending rather than potential tax hikes, with higher yields and a stronger US dollar combining with buoyant equities and firm credit spreads over the course of the month.

The US Federal Reserve and the European Central Bank reaffirmed their commitment to easy funding conditions; neither appears worried about near-term inflation pressure. Economic data released during the month was mixed, with unseasonably cold weather in the US weighing on activity, but global sentiment indicators were strong, in line with optimism around the post-pandemic reopening. The UK and US continued to open up their economies as vaccine rollouts progressed, but Europe continued to struggle.

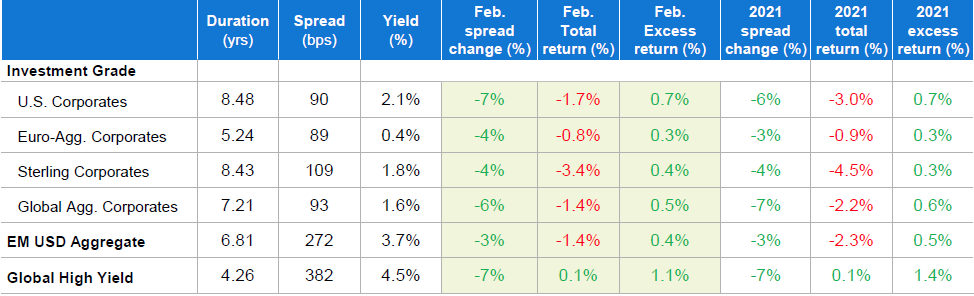

Credit spreads ended March generally unchanged, but there were pockets of weakness within emerging markets. Local currency emerging market assets have suffered as the dollar has rallied; there are also several vulnerable countries, such as Turkey and Brazil, where political volatility has led to particular weakness. Saudi Arabia surprisingly agreed to maintain oil production cuts, helping to support prices; oil suffered a modest correction towards the end of the month, interrupting its recent very strong run.

Key market moves: March and YTD

Source: as at 31 Mar. 2021. Bloomberg Barclays index returns are USD Hedged for Global indices, and in local currency for the others.

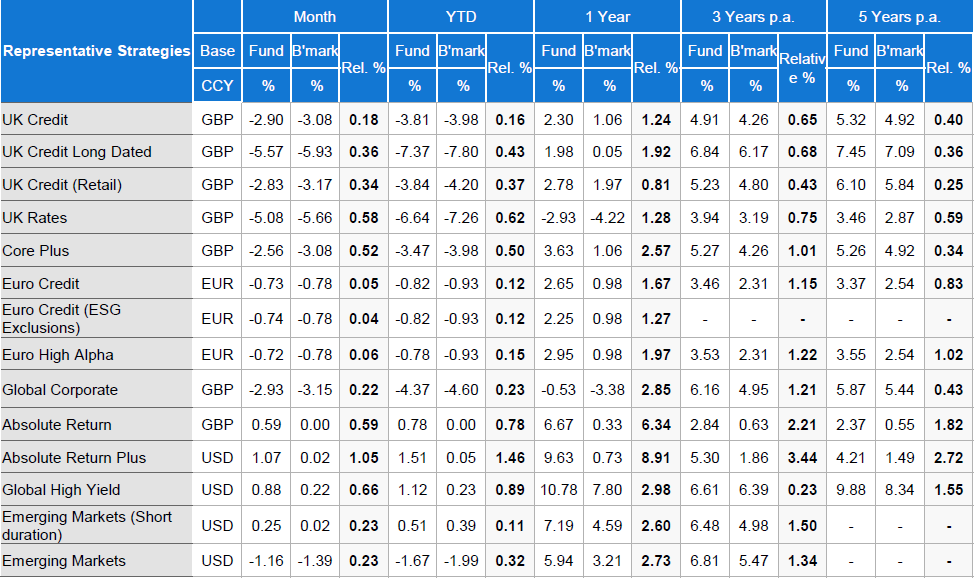

Fund performance

Source: LGIM 31 Mar. 2021. Past performance is not a guide to the future.