I have been entertained this past week by a series of posts on trade - but frightened by unenlightened thoughts expressed by a new Congressional leader.

Follow up:

Before looking at at any of these posts, we should look at the REAL trade statistics - and how important exports are to the USA economy. The graph below shows the FRACTION (not percentage) of exports to GDP. Note that exports are a growing and becoming a significant portion of the economy (almost 13% of GDP).

You might be surprised that exports are such a large component of the economy. This is because most analyze the trade deficit - and therefore lose sight of the movements of imports and exports. Now let us read four posts:

- Professor Krugman - America As A Lousy Exporter

- Alan Tonelson - (What’s Left of) Our Economy: Paul Krugman’s a Fake-onomist on Trade

- The Cost of the Credit Programs of the Export-Import Bank

- and the scary one - Next House Leader Says He Would Let Trade Bank Expire

International trade is not played on a level playing field. Not only do governments game their exchange rates, but they also game export prices, tax refunds for exports, bribe the potential buyers - and offer government supplied and discounted export financing.

If you are an American company, try to hock your goods without good financing when the guy next to you is bringing the weight of his government's export-import bank (exim) to the table. I have personally gone up against this phenomenon, and the results are not pretty if you cannot offer exim financing.

Now think about the effect on American business without exim financing. Exim offers discounted loans - something the private sector cannot do. Yes, it is not fair that primary beneficiary of exim is to the big boys in business - but life is not fair, and then you die.

If the USA gives up exim financing - it forces the Boeings of this world to manufacture in countries that will support them in providing export financing. Killing the USA Exim Bank is akin to killing the golden goose. And one final point - export financing (as well as project financing) is a component of foreign policy - not only to stimulate trade but to extend influence. Talk of killing USA Exim financing comes at a time when China is doing the opposite.

Do some politicians have a death wish for the economy?

Other Economic News this Week:

The Econintersect Economic Index for June 2014 is showing continued growth acceleration. Outside of our economic forecast - we are worried about the consumers' ability to expand consumption because the ratio between income and expenditures is near all time highs. The GDP contraction for 1Q2014 is a paper contraction as GDP is determined by playing games with accounts. No serious element of the economy was in contraction (except government spending) which is already expanding in the 2Q2014.

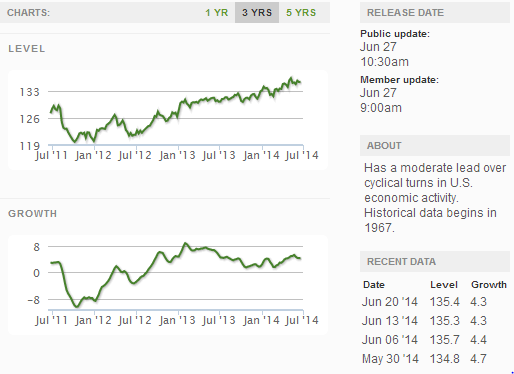

The ECRI WLI growth index value has been weakly in positive territory for many months - but now in a noticeable improvement trend. The index is indicating the economy six month from today will be slightly better than it is today.

Current ECRI WLI Growth Index

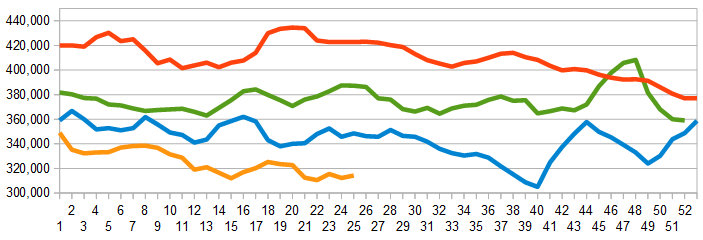

The market was expecting the weekly intial unemployment claims at 305,000 to 315,000 (consensus 310,000) vs the 312,000 reported. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 312,250 (reported last week as 311,750) to 314,250.

Weekly Initial Unemployment Claims - 4 Week Average - Seasonally Adjusted - 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line)

Bankruptcies this Week: Revel AC, Privately-held Nautilus Holdings, Privately-held Source Home Entertainment

Weekly Economic Release Scorecard:

Click here to view the scorecard table below with active hyperlinks