Investing.com’s stocks of the week

Here are a few interesting charts from last week's Commitment of Traders report:

Chart 1: Positioning in the Euro has now exceeded 11 billion dollarsEUR/USD Chart" title="EUR/USD Chart" src="https://d1-invdn-com.akamaized.net/content/picaf426f404a0d8819b3ac871a6477e139.png" height="695" width="908" />

Over the last two weeks, the US dollar has broken down from its rising trend line, mainly thanks to European currencies like the euro, Swiss franc and the pound. The chart above shows that hedge funds and other speculators now hold over 11 billion dollars of exposure on the euro, the highest net long bet since the middle of 2011.

I am not so sure that it is all too wise to buy the euro right now, with net long exposure this high. Previous instances with net long exposure over $10 billion have led to sell offs in recent years. Nonetheless, a breakout is a breakout and certain traders will respect prices signals above all else.

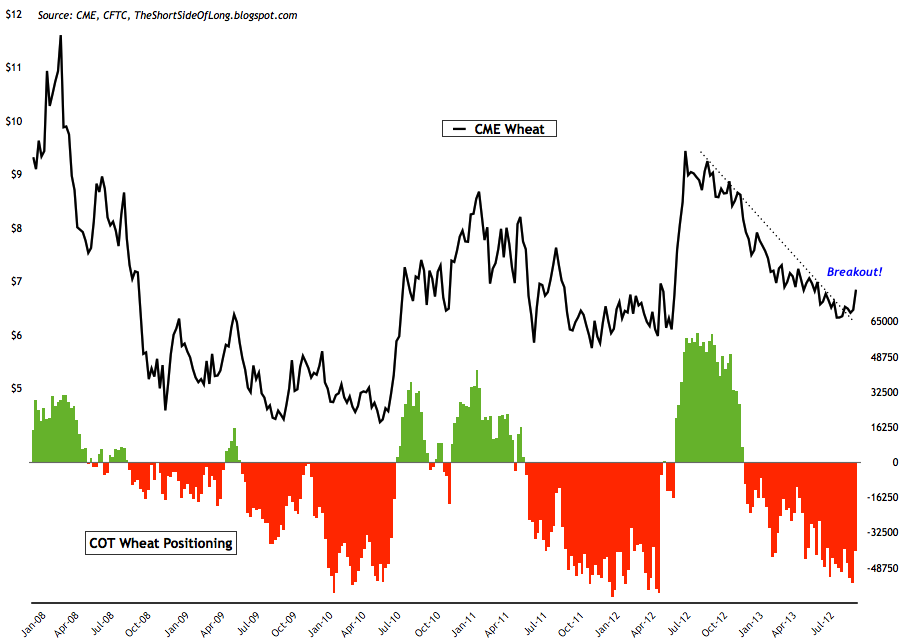

Chart 2: After a huge short build up, Wheat prices are also breaking out!

While Wheat finds itself in a similar position to the euro, where the price is breaking out of its recent downtrend, the major difference here is that we can see hedge funds and other speculators holding insanely high exposure of net short bets. Similar instances where traders built up huge shorts, resulted in massive price rises as the short squeeze killed the bears. The overall agricultural complex is very much disliked right now, with near record short positions on Corn and Coffee.

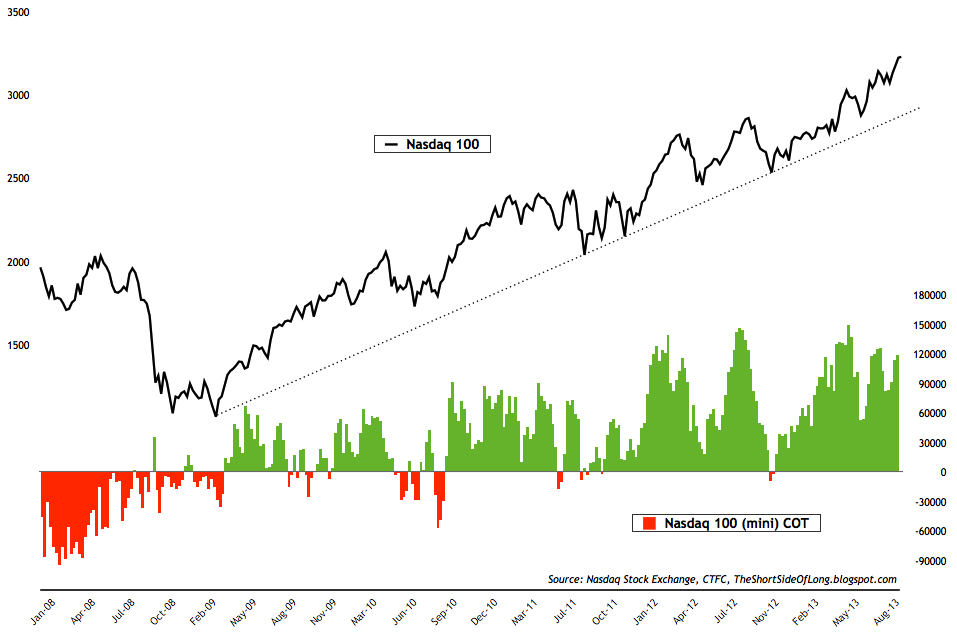

Chart 3: Speculators are betting on further increase in stock prices

Finally, the chart above looks at the exposure towards US equities, and in particular the Nasdaq 100 index. Exposure is once again reaching extremely high levels, with bets approaching 120,000 net longs. This sentiment indicator confirms bullishness seen in other indicators like put/call ratios, fund flows, extremely low volatility, extremely low volume, near record fund manager equity exposure, very high margin debt, dramatically low cash levels by retail investors and so forth.