The accommodative monetary policies of central banks are encouraging risk-taking in investors who can hardly be satisfied with the bond market’s low returns. In this context, credit spreads are compressed and stock markets continue to climb, thereby supporting the CAD.

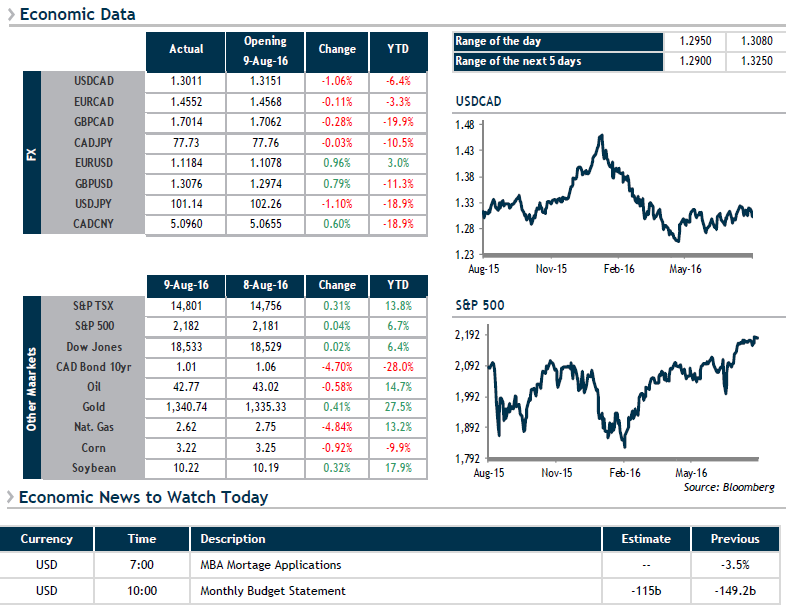

Since the beginning of 2016, the S&P500, the S&PTSX in Toronto and the MSCI index for emerging countries are up 6.7%, 13.8% and 12.8% respectively. This risk-taking is resulting in decreased volatility for most asset classes. Caution is therefore key as market highs generally coincide with low points in terms of volatility. The VIX, which measures the implied volatility of options traded on the S&P500, is at 11.47%., a two-year low.

In anticipation of USD Crude Oil Inventories data expected at 10:30 this morning, the Canadian dollar is up against most major currencies. Buyers of USD should therefore put in orders to take advantage of movements under 1.3000.