With second-quarter earnings about to gather pace, the overall scenario is far from rosy. Notably, for the quarter, total earnings are expected to be down 6.2% on 0.6% lower revenues. Moreover, challenges are expected to dent the performance in the current as well as upcoming quarter, with growth unlikely before late 2016.

Turning to the leisure stocks, we note that the first quarter was somewhat lackluster in the U.S. This was attributable to factors such as a strong dollar, challenges posed by new technology and a damaging international performance.

However, leisure companies usually see an uptick during the spring and summer seasons. Also, growth in the leisure sector is directly proportional to consumers’ disposable income.

Despite declining energy prices, consumers are increasing their spending only modestly, as an increase in jobs this year is yet to translate into significantly higher wages. Higher health care costs and still tightened credit availability also lowers consumer discretionary spending in the U.S.

Two leisure companies are set to report their quarterly numbers on Jul 14. Let’s take a look at what might be in store for them this quarter:

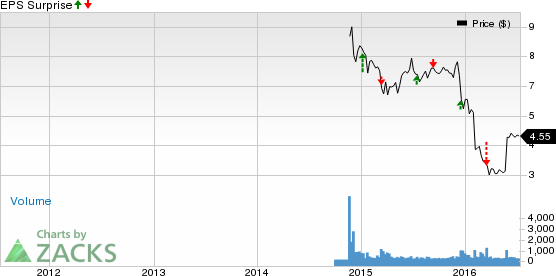

ClubCorp Holdings, Inc. (NYSE:MYCC) , a membership-based leisure company, is slated to release its second-quarter 2016 results before the market opens.

Last quarter, ClubCorp Holdings had posted a 30% negative earnings surprise. In fact, the company delivered negative earnings surprises in all of the past four quarters, with an average miss of 93.66%.

Notably, our proven model does not conclusively show that ClubCorp Holdings is likely to beat the Zacks Consensus Estimate this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. Unfortunately, that is not the case here as elaborated below:

The Earnings ESP for ClubCorp Holdings is -58.33%. This is because the Most Accurate estimate stands at 5 cents while the Zacks Consensus Estimate is pegged higher at 12 cents. Meanwhile, the company has a Zacks Rank #3 which increases the predictive power of ESP. However, the company’s negative ESP makes surprise prediction difficult.

Owner and operator of ski resorts in the U.S., Peak Resorts, Inc. (NASDAQ:SKIS) , is scheduled to post fourth-quarter and fiscal 2016 financial numbers, before the opening bell.

Last quarter, Peak Resorts posted a 35.00% negative earnings surprise. In fact, the company missed the Zacks Consensus Estimate in two of the last four quarters, with an average miss of 8.27%.

Meanwhile, the Earnings ESP for Peak Resorts is 0.00% as the Most Accurate estimate and the Zacks Consensus Estimate are both pegged at 64 cents. The company carries a Zacks Rank #3, but that alone is not enough to secure an earnings beat.

Stay tuned! Check back on our full write-up on earnings releases of these stocks.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report >>

PEAK RESORTS (SKIS): Free Stock Analysis Report

CLUBCORP HLDGS (MYCC): Free Stock Analysis Report

Original post