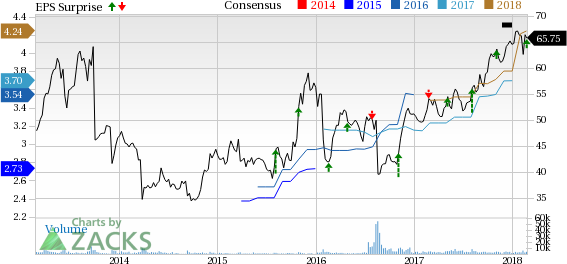

Leidos Holdings, Inc. (NYSE:LDOS) reported fourth-quarter 2017 adjusted earnings of 87 cents per share, beating the Zacks Consensus Estimate of 83 cents by 4.8%. Earnings improved 16% from the year-ago quarter's figure of 75 cents.

Excluding one-time items, the company reported GAAP earnings of 74 cents per share, compared with the prior-year quarter’s earnings of 39 cents.

For 2017, the company reported adjusted earnings of $3.72 per share, beating the Zacks Consensus Estimate of $3.70 by 0.5%. The reported number also improved 6% from the year-ago $3.51.

Total Revenues

Leidos Holdings posted total revenues of $2,516 million in the quarter, which missed the Zacks Consensus Estimate of $2,586.5 million by 2.7%. The figure also deteriorated 2.3% year over year.

For 2017, the company posted total revenues of $10.17 billion which lagged the Zacks Consensus Estimate of $10.24 billion by 0.7%. However, revenues improved 44.4% year over year.

Backlog

At the end of 2017, the company’s backlog of signed business orders was $17.5 billion, of which $5 billion was funded. Total backlog at the end of 2016 was $17.7 billion, of which $5.9 billion was funded.

Operational Statistics

Total cost of revenues in the reported quarter declined1.5% to $2,231 million. Operating income was $101 million, compared with $152 million in the year-ago quarter.

Interest expenses totaled $38 million, down from $39 million in fourth-quarter 2016.

Segment Performance

Defense Solutions: Net sales at the segment dropped 3.8% to $1,221 million from the prior-year figure of $1,269 million. Moreover, operating income declined to $85 million from the year-ago tally of $88 million. Meanwhile, operating margin expanded 10 basis points (bps) to 7%.

Health: The segment recorded net sales of $441 million in the reported quarter, down 0.5%. While operating income declined 8.3% to $44 million, operating margin contracted 80 bps to 10%.

Civil: Net sales at the segment were $854 million, down 0.9%. Operating income fell 15.2% to $56 million and operating margin contracted 110 bps to 6.6%.

Financials

Cash and cash equivalents as of Dec 31, 2017, were $390 million, compared with $376 million as of Dec 30, 2016. Net cash inflow from operating activity in 2017 was $526 million, compared with $449 million a year ago.

Guidance

Leidos Holdings issued its 2018 guidance. The company expects adjusted earnings per share in the range of $4.15 to $4.50 on revenues of $10.25-$10.65 billion.

Adjusted earnings before interest, tax, depreciation and amortization margin is anticipated in the range of 10.1-10.4%. Leidos Holdings expects to generate cash flow from operating activities of $675 million or more in 2018.

Peer Releases

Spirit AeroSystems Holdings (NYSE:SPR) recorded fourth-quarter 2017 adjusted earnings of $1.32 per share, which beat the Zacks Consensus Estimate of $1.22 by 8.2%.

Boeing Company (NYSE:BA) reported adjusted earnings per share of $4.80 for fourth-quarter 2017, beating the Zacks Consensus Estimate of $2.91 by 64.9%.

Lockheed Martin (NYSE:LMT) reported fourth-quarter 2017 adjusted earnings from continuing operations of $4.30 per share, which surpassed the Zacks Consensus Estimate of $4.06 by 5.9%.

Zacks Rank

Leidos Holdings has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

Boeing Company (The) (BA): Free Stock Analysis Report

Lockheed Martin Corporation (LMT): Free Stock Analysis Report

Leidos Holdings, Inc. (LDOS): Free Stock Analysis Report

Spirit Aerosystems Holdings, Inc. (SPR): Free Stock Analysis Report

Original post

Zacks Investment Research