- New record highs for bitcoin.

- The new alternative asset class of choice.

- Why taking action before Aug. 28 is imperative.

It’s Friday in the Wall Street Daily nation.

For the new kids on the block hanging tough, that means it’s time to go to the charts.

Each week, I pull together a collection of graphics to convey some important and timely investing insights.

This go-round, there’s only one chart that really matters. But we’re including one other chart to set the stage.

Without further ado:

The New Alternative Asset of Choice

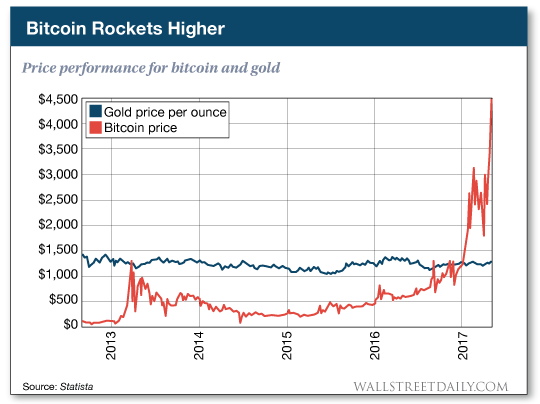

Bitcoin continues to soar to record highs.

Forget $3,000, the first cryptocurrency game in town blew through that previous record and topped $4,000 recently.

What’s most interesting about the latest spike is what caused it… That is, rising political tensions with North Korea.

Traditionally, gold would have spiked on such a development. But it barely budged, rising less than 5%.

The fact that investors are pouring capital into bitcoin instead of gold signifies that cryptocurrencies are being established as the new alternative asset class of choice.

Or more simply, no longer are cryptocurrencies relegated to the fringe. They’re going mainstream.

And that’s our cue to pay immediate attention.

Follow the Money Trail

As you know, my team of analysts and I constantly track the markets and the flow of money into new technologies. That includes monitoring venture capitalists, as they’re often the first to fund truly game-changing technology.

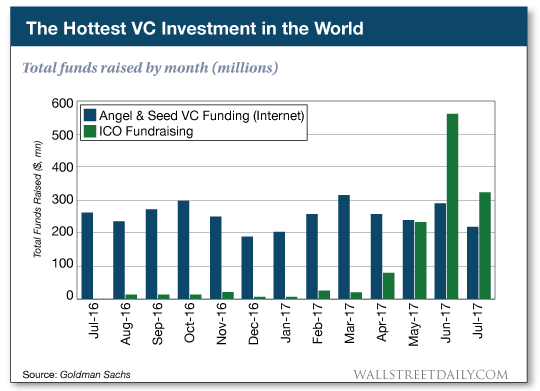

What are the latest flows telling us? Well, in all my years of investing, I can confidently say I’ve never seen a more rapid and massive migration of capital than we’re witnessing in the cryptocurrency market right now.

In the last month alone, four cryptocurrency projects raised a staggering $660 million.

What’s more, the latest data from Goldman Sachs (NYSE:GS) reveal that ICO funding surpassed angel- and seed-stage funding for internet companies for two consecutive months.

For those unaware, an ICO is the equivalent of an IPO for a new cryptocurrency.

Clearly, this isn’t a passing fad but a major area of focus for the world’s savviest investors.

Need more proof?

Consider this:

- A marquee venture capitalist just left his post at Union Square (NYSE:SQ) to invest solely in crypto assets. He’s reportedly secured $100 million worth of investor funds to launch his initiative. This is only the beginning, though. Based on our early research, at least 15 more crypto hedge funds will launch before the end of the year. Especially since one of the first cryptocurrency hedge funds is allegedly up 2,129% so far this year. (Act before Aug. 28 for your shot at a quadruple-digit gainer.)

- The former head of Morgan Stanley (NYSE:MS), John Mack, who’s been “watching and investing in the cryptocurrency market over the last several years,” is now part of a firm that will act as a middleman for traditional asset managers that want to own cryptocurrencies. This is a precursor to massive institutional adoption.

Bottom line: There’s no single investment attracting more attention and money right now than cryptocurrencies. What follows next is full-fledged aggressive investment and, most importantly, quadruple-digit profit opportunities for those savvy enough to position their portfolios properly.

If you want to count yourself among them, you need to act before Aug. 28. That’s when the hottest ICO on Earth is set to debut.

Ahead of the tape.