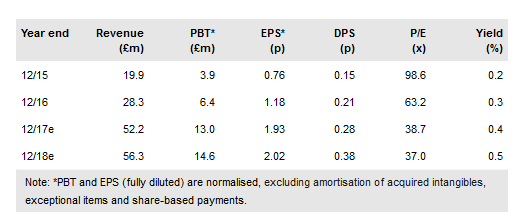

Learning Technologies Group PLC (LON:LTGL) has released a strong trading update with FY17 profits and year-end net cash comfortably ahead of consensus. The update indicates that operating margins were c 190bp ahead of our forecasts, with net cash £7.9m ahead. However, we are maintaining our FY18/FY19 forecasts, which were recently updated in our monthly book. In October, LTG announced its objective to double run-rate revenues to £100m and achieve run-rate EBIT of at least £25m by the end of 2020. While the shares look punchy on c 37x our FY18 EPS, the business is attractively positioned in an industry growing at 15-20% and we note that sustainable high-teen growth opportunities are hard to find across the broader market.

Trading update: Surprise early swing into net cash

FY17 revenues were at least £51.8m (we forecast £52.2m) while adjusted EBIT was not less than £14m (we forecast £13.1m), implying operating margins were 27.0% (25.1%) and the company has a record order book. The group ended the year with net cash of c £1.0m (we forecast net debt of £6.9m). We believe the high levels of cash were due largely to Q4 licence sales at Rustici and NetDimensions (that invoices significant recurring software licences in Q4), as well as the exercise of employee share options and cash conversion came out at the higher end of the target range of 80-90%. Further, LTG says it has “an encouraging pipeline of international acquisition opportunities as it seeks to diversify and deepen its strategic consultancy, creation, delivery, and analytics offering...”

To read the entire report Please click on the pdf File Below: