Good day traders!

Today's focus is on USD/JPY and its short-term Elliott wave pattern. Let's dig in!

USDJPY is moving down for the last few days in shape of a contracting wedge, which can be a leading diagonal in wave A) as part of a new big three wave structure, this time to a bearish side. If that's the case, then market may not give us much clarity in days ahead, but it may turn up from 112.00 area.

USD/JPY, 1H

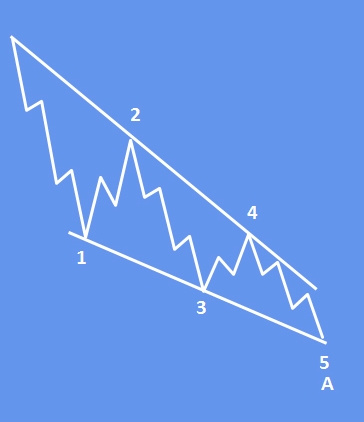

When diagonal triangles occur in the fifth or C wave position, they take the 3-3-3-3-3 shape that Elliott described. However, it has recently come to light that a variation on this pattern occasionally appears in the first wave position of impulses and in the A wave position of zigzags. The characteristic overlapping of waves one and four and the convergence of boundary lines into a wedge shape remain as in the ending diagonal triangle. However, the subdivisions are different, tracing out a 5-3-5-3-5 pattern.

- structure is 5-3-5-3-5

- a wedge shape within two converging lines

- wave 4 must trade into a territory of a wave 1

- appears in the wave one position in an impulse, in the A wave position of A-B-C

Example of an EW leading diagonal:

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All our work is for educational purposes only.