Street Calls of the Week

Here is the weekly chart of Lead:

It looks like that lead has completed its first 5 wave structure and now is due for a correction. Most often these candles (Shooting star) when appears on top, reflects complete reversal. RSI has exited from overbought region and trying to find the way towards south whereas MACD is still in buying mode.

Let's move towards the daily chart for some more clue for upcoming direction.

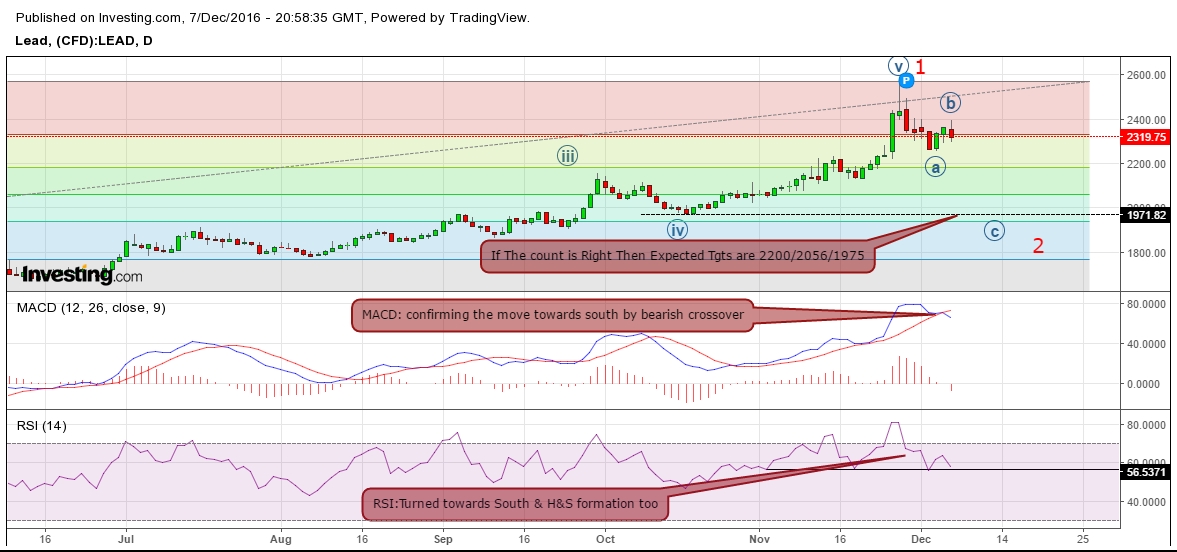

Here is the daily chart of Lead: If my primary counts are right then we are now in corrective (a,b,c) phase. MACD and RSI both are indicating for a move towards south and as we know that most probable target / support zones of corrective waves are the wave (IV) of a lesser degree wave count, 1970 area in this case which sits just above 61.8% retracement of entire bull move from 1581 to 2571.75. Lets move towards a more lower time frame to be more specific about structure.

Here is the 5 hr chart of lead, any break below 2257 will be a further indication of a correction for the potential down move up to 1975 area.

Right now we are with bears with a price objective of 2200 followed by 2056 and 1975 with strict stops above 2572. Whether i am right or wrong will be confirmed by the market action in next few days. any move below 2257 will add more confidence to bears whereas the move above 2415 will open the gate for 2450 and 2500 levels which seems unlikely right now.

Lets see what happens next.

Resistance: 2415/2450/2505

Support : 2246/2125/1970