Investing.com’s stocks of the week

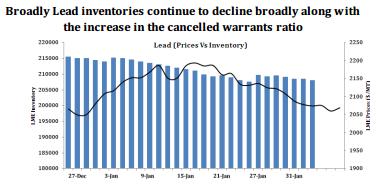

Broadly the lead inventories have been broadly declining since last three months and the cancelled warrants for the commodity also surged over 35% in the last two to three weeks which are presently at two month high levels indicating increase in t

--Lead was the another gainer along with the aluminum in the yesterday's trading session at the LME platform up by 0.4%.

--Broadly the lead inventories have been broadly declining since last three months and the cancelled warrants for the commodity also surged over 35% in the last two to three weeks which are presently at two month high levels indicating increase in the orders to remove the metal from the warehouses.

--For day, we recommend buying lead from the lower levels as we expect the commodity to get support from the anticipated increase in demand due to the abnormally low temperatures in the US and a lack of availability of refined lead due to the closure of the DOE run Herculaneum lead smelter.