Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Lead pulls back following a Q3 price rally. Source: MetalMiner analysis of Fastmarkets.com data.

Lead fell in October but the underlying trend looks strong. Let’s analyze why prices declined:

Strong Dollar In October

The U.S. dollar index rises in October. Source: Metalminer analysis of @Stockcharts.com data.

In October, the U.S. dollar index, which measures the greenback vs. a basket of major currencies, rose to its highest level in 9 months.

A rising dollar has a negative impact on metal prices. Not only lead, but all base metals are feeling the downward pressure this month. Metals are priced in dollars and when the value of the dollar rises, it takes more of them to buy metals. Another reason is that when the value of the dollar rises, foreign buyers have less buying power, typically causing demand for metals to shrink.

Lead Needs To Consolidate Gains

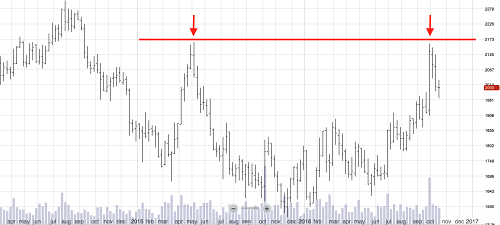

Lead faces long-term resistance level. Source: Fastmarkets.com.

Lead moved up sharply in Q3 and prices need to consolidate these gains. It is normal to see some profit-taking at these levels. Moreover, lead is at levels that prices couldn’t overcome last year. This is a level where it’s normal to see some selling pressure. Interestingly, its metal cousin zinc is doing the same thing.

What This Means For Metal Buyers

Lead prices are consolidating recent gains and a stronger dollar is weakening the bullish mood across base metals. Prices could continue to climb higher after this pause. Lead buyers should consider hedging some purchases.

by Raul de Frutos