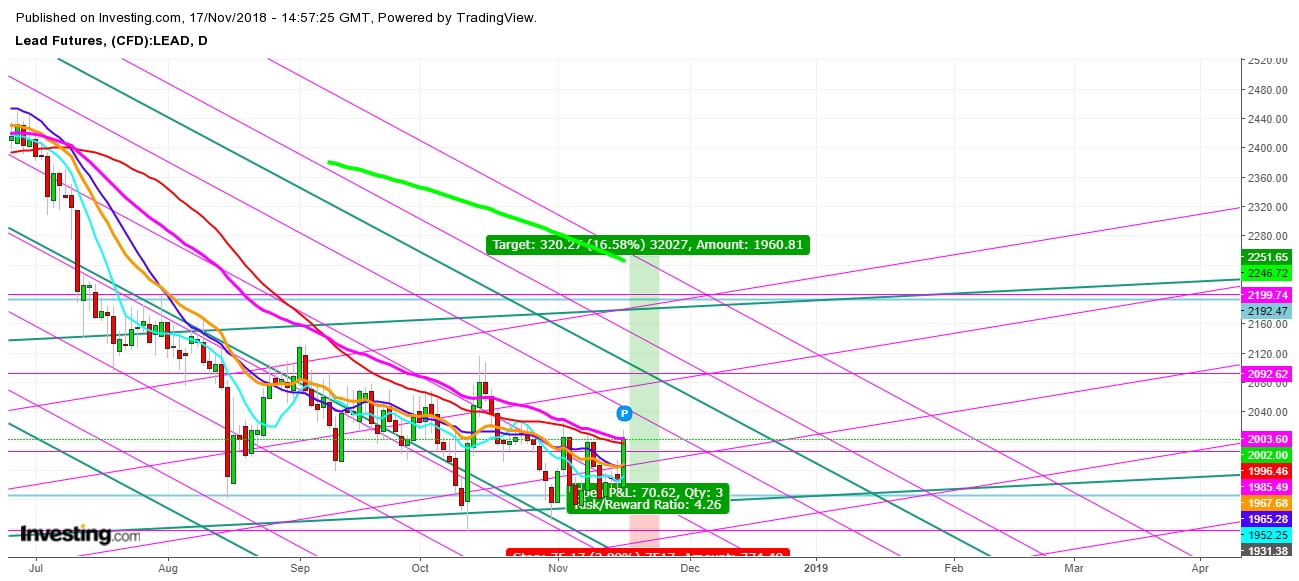

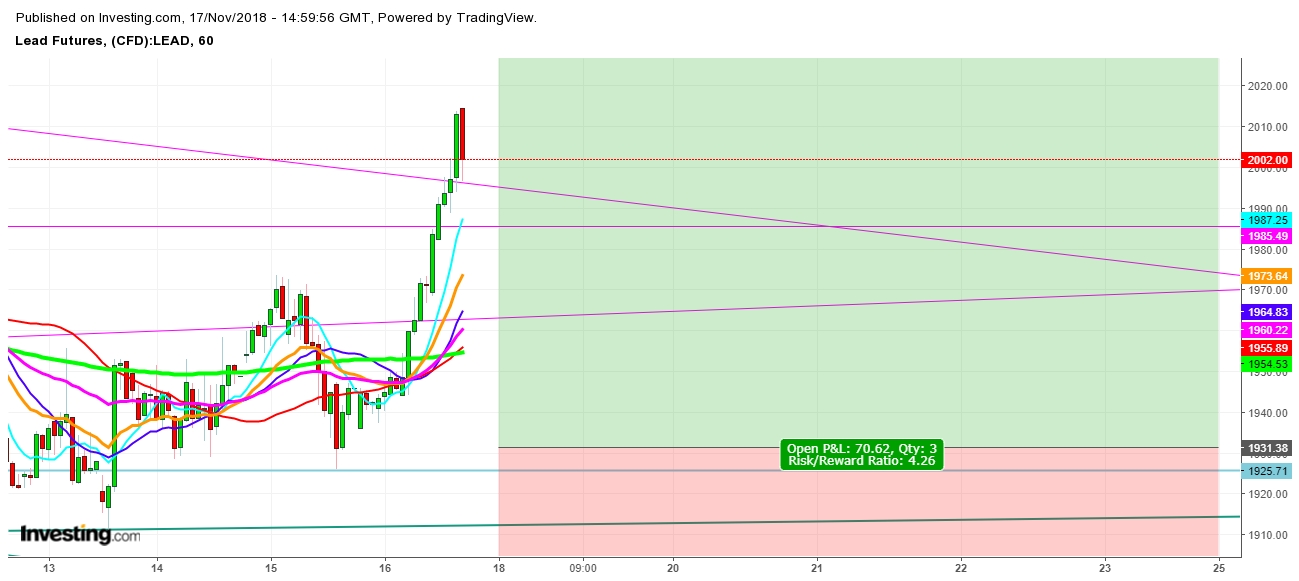

On analysis of the movements of Lead futures in different time frames, I find that the Lead futures look steady, after a strong upward move during the last two trading sessions of the previous week; and look to have an eye at the upper consolidation zone from $1990 to $2117. Although, formation of a bearish hammer candle in an hourly chart before the weekly closing is evident enough for growing volatility ahead, but I find Lead futures may be a good buy only at the lower levels, below $1919 with a Stop Loss order at $1855 for a target above $2182. No doubt that the opening level on the first trading session of the Week will play a decisive role in defining the further directional moves of the Lead futures, but only a sustainable move above the level of $2077 will confirm an upward move of Lead futures. Let’s have a look at the movements of Lead futures in the following charts.

Disclaimer: This analysis is only for educational purpose. Readers are requested to kindly consider their own view first, before taking any position.