Investing.com’s stocks of the week

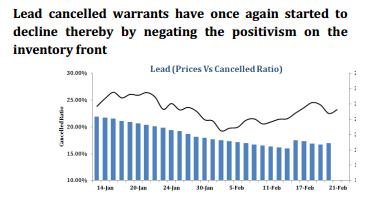

--The Lead inventory picture is depicting mixed cues wherein the inventories and the cancelled warrants are declining simultaneously. The cancelled warrants have declined from a high of 46,275 MT to 33,575 MT in the last twenty eight trading sessions which is nearly a fall of 23% indicating lack of immediate requirement for the metal.

--The global auto sales numbers continues to be mixed wherein the US auto sales number for the January month declined while the automobile sales in the Euro-zone increased a tad by 5% on a year or year basis. However the E.U car sales data still looks weak when compared to its previous figure of 13.3% on a month on month comparison. Auto sales in India too depict a slight negative picture where in the car sales declined by 3% on a monthly basis.

--For the week, we hold a ranged outlook with a slight negative bias on the commodity as the metal on one hand might take positive cues from its declining inventories. On the other hand the metal might negative cues from the mixed auto sales data around the globe and declining cancelled warrants. For the day we recommend selling Lead from the higher levels as the commodity may broadly decline along with the other base metals due to the negative developments in China.