Today we are highlighting what we believe is the momentum impulse move in gold that will become the catalyst for the future move in gold and silver throughout the rest of this year and likely all of 2020. The key element to launch gold and silver beyond current resistance levels is bound by two factors and could be boosted by a third. The first two factors are “fear and greed”.

Investors are continually searching for suitable investments with healthy returns and moderate risk. As we have learned from the past, capital will flow into any investment, even instruments that include incredible long term risk factors, when the opportunity exists for gains and risk is mitigated. The current upside price move in gold is just such an event.

The recent news items add additional fuel to the precious-metals rally because they foster increased fear related to the global economy and potential military action or increased uncertainty. This fear translates into the action of “protect my investments that may be exposed to greater risk and find an investment that reduces this risk and provides for greater returns/gains”. That is the question gold investors are asking themselves all over the world right now.

The booster fuel, which would drive gold and silver into another galaxy is the U.S. Dollar. If the U.S. dollar were to weaken, even by 4% to 7%, while a global uncertainty event continued to unfold, we believe this valuation pressure would push gold and silver well above our current expectations.

When we think about the current environment for precious metals, one has to understand that fear and greed don’t have to be tangible or overwhelming. This process is almost like a perpetual motion machine. Once the process gets started where investors pile into gold because of the fear and greed factors, the price of gold rises. Because the price of gold rises, traders start to pay closer attention to what is happening in gold and the greed factor starts to increase. Once they are convinced this is a bigger opportunity and their fear levels are still valid, the conclusion is “I don’t want to miss this move in gold, so I’ll get it now – before the big move happens”.

It is as simple as that. And this is why we are saying, “T-Minus Three Seconds” before the big breakout move really takes shape. That is our way of saying, it could happen any day now. The breakout move and the momentum base appear to be ready to go.

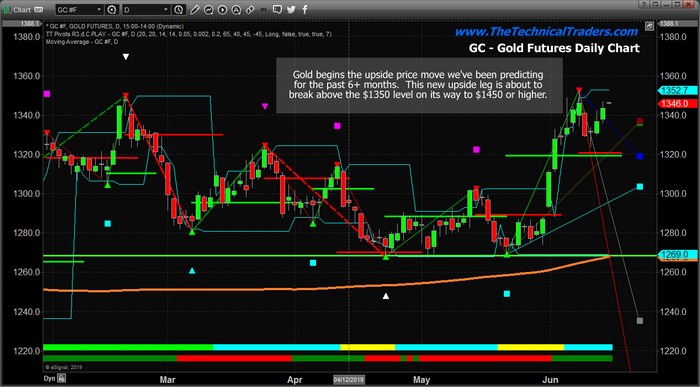

This gold daily chart highlights the recent upward price move and shows just how quickly price can rally. This resulted in a $75 price rally (+6%) in a matter of 10+ days. Imagine what that will look like after gold breaks above $1650 on the fear/greed move.

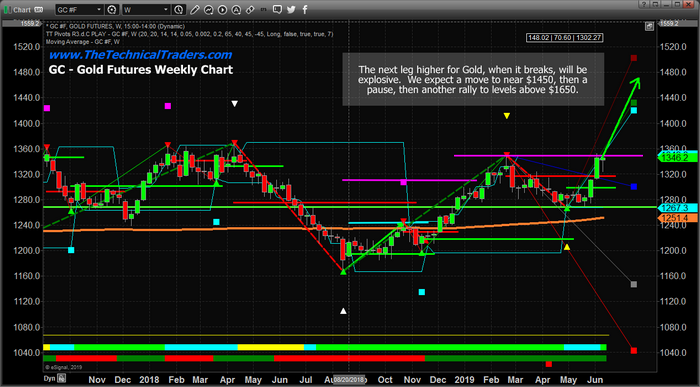

This gold weekly chart highlights what we expect to be the first upside leg – the move to $1450. After that, we expect a brief pause in the rally (possibly 7 to 21+ days), then another big move higher where the price will rally above $1650. That bigger move should solidify the focus of global investors and, much like the big move in Bitcoin, should attract a large number of investors not wanting to miss the rest of the upside move.

Silver is what we are calling the “sleeper trade” for precious metals bugs. Sure, gold has all the action right now because it is the leading metal to offset this fear/greed factor. silver always lags behind gold because it is the “little brother” to the bigger players in gold. As our research has shown, when the move begins, silver is actually a better trade than gold because it will likely increase in price by a factor of 1.4 to 1.8 compared to the rally in gold prices.

We believe the next move in silver will target $18 to $20. These price levels below $15 are a gift for anyone willing to take the trade.

This monthly silver chart shows what we believe will be the upside price waves as silver advances past $22. Read the research posts, above, again to learn more about our more detailed expectations. It is all right there for you to see and understand.

T-Minus Three And Counting

We believe this setup is about to break to the upside and there is not much time left to see prices near these levels. Below $1400 in gold and below $15 in silver are about to end. When this really does begin to lift off as we’ve been predicting, we may never see these price levels again. Well, at least in the foreseeable future.