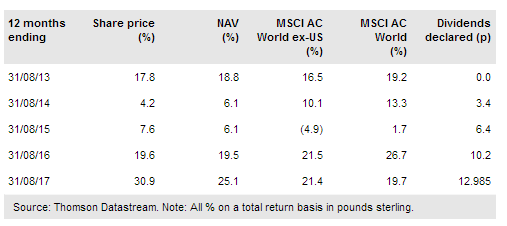

Lazard World Trust Fund (LON:WTR) (formerly The World Trust Fund) offers investors access to a concentrated portfolio of the ‘best ideas’ of Lazard Asset Management’s Discounted Assets team, who manage more than $5bn of assets invested globally in undervalued companies, such as closed-end funds, investment trusts and holding companies that are trading at a discount to the value of their assets. Following a number of changes in 2016, the fund now pays a distribution of 3.5% of year-end NAV, making it the highest-yielding fund in its peer group, and, as requested by shareholders, has a new benchmark (MSCI AC World ex US rather than the US-heavy MSCI AC World) that better reflects its international focus and high weighting in emerging markets. Recent performance has been strong, and the manager sees many exciting opportunities in areas such as China, India, Vietnam, Brazil, Romania, and smaller companies in the US and Europe. The fund can also hedge equity and currency exposures.

Investment strategy: Identify and unlock hidden value

WTR’s approach is to invest actively in a portfolio of actively managed closed-end funds, investment trusts and holding companies, chosen from around the world in a manner largely unconstrained by benchmark weightings. Lazard’s Discounted Assets team employs a four-stage approach to identifying companies that are trading at a discount to their asset value and where underlying holdings may also be discounted. All holdings should have an identifiable catalyst for revaluation; the team engages frequently on corporate governance initiatives to help unlock this hidden value.

To read the entire report Please click on the pdf File Below: