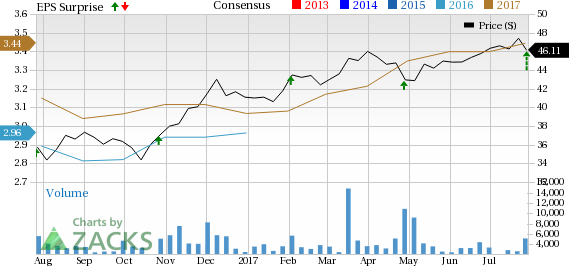

Lazard Ltd. (NYSE:LAZ) reported a positive surprise of 22.5% in second-quarter 2017. The company reported adjusted earnings of 98 cents per share, comfortably surpassing the Zacks Consensus Estimate of 80 cents. Further, the reported figure compared favorably with 61 cents earned in the prior-year quarter.

Strong top-line performance and growth in assets under management (AUM) were positives. However, escalating expenses were a major drag.

Shares of Lazard lost 3.76% following second-quarter 2017 earnings release. Despite earnings beat, perhaps, lesser support on the expense front led to investors’ bearish stance.

Adjusted net income in the quarter came in at $130 million, up 62% year over year. On a GAAP basis, Lazard’s net income came in at $120 million or 91 cents per share compared with $80 million or 61 cents recorded in the prior-year quarter.

Revenue Escalates, Costs Pressure Persist

In the second quarter, adjusted operating revenues came in at $720 million, up 33% year over year. The upsurge can chiefly be attributed to an increase in financial advisory revenues, as well as asset management revenues. Moreover, revenues outpaced the Zacks Consensus Estimate of $613 million.

Adjusted operating expenses were around $523 million in the quarter, up 24.9% year over year. Higher compensation and benefits and non-compensation expenses led to the upsurge.

Adjusted compensation and benefits expense flared up 33% on a year-over-year basis to $406.9 million. Adjusted non-compensation expense for the quarter was $116.1 million, up 4% year over year.

The ratio of compensation expense to operating revenue was 56.5%, in line with the prior-year quarter. The ratio of non-compensation expense to operating revenue was 16.1% compared with 20.7% in the prior-year quarter.

The company affirmed its annual targets of an adjusted non-compensation expense-to-revenue ratio between 16% and 20%, while the compensation-to-operating revenue ratio target is in the mid-to high 50 percentage range.

Segment Performance

Financial Advisory: The segment’s total revenue was $411 million, up 43% from the prior-year quarter. The rise was primarily due to an increase in revenues from M&A and strategic advisory, as well as higher restructuring revenues.

Asset Management: The segment’s total revenue was $307 million, up 22% from the prior-year quarter. Higher management, incentive and other fees led to the rise.

Corporate: The segment generated total revenue of $2.5 million, which plunged 46% from the prior-year quarter.

Strong Assets Under Management (AUM)

As of Jun 30, 2017, AUM was recorded at $226 billion, up 18% year over year. The quarter experienced market and foreign exchange appreciation of $10.9 billion, partially offset by net outflows of $365 million.

Average AUM came in at $222 billion, rising 15% year over year.

Stable Balance Sheet

Lazard’s cash and cash equivalents stood at $956 million as of Jun 30, 2017, compared with $1.16 billion as of Dec 31, 2016. The company’s stockholders’ equity was $1.30 billion compared with $1.29 billion as of Dec 31, 2016.

Steady Capital Deployment Activity

During second-quarter 2017, Lazard returned $133 million to its shareholders. This included dividend payment of $50 million, share repurchase of $79 million and $4 million paid for meeting employee tax obligations in exchange of share issuances upon vesting of equity grants.

Our Viewpoint

Results reflect a decent quarter for Lazard. Though the company’s diverse footprint, steady capital deployment activities and revenue strength position it favorably for the long run; macro headwinds, elevated costs pressure and stringent regulations put the company’s financials under strain.

Currently, Lazard carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Competitive Landscape

T. Rowe Price Group, Inc. (NASDAQ:TROW) reported positive earnings surprise of 0.8% for second-quarter 2017. Adjusted earnings per share of $1.28 outpaced the Zacks Consensus Estimate by a penny. Further, the bottom line improved 15.3% from the year-ago figure of $1.11.

Ameriprise Financial Inc.’s (NYSE:AMP) second-quarter 2017 operating earnings per share of $2.80 comfortably surpassed the Zacks Consensus Estimate of $2.62. Also, the figure represents a year-over-year increase of 26%.

The Blackstone Group L.P. (NYSE:BX) reported second-quarter 2017 economic net income (ENI (MI:ENI)) of 59 cents per share, which lagged the Zacks Consensus Estimate of 62 cents. An increase in expenses was the primary reason for the lower-than-expected results. However, the quarter witnessed a rise in revenues.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

T. Rowe Price Group, Inc. (TROW): Free Stock Analysis Report

AMERIPRISE FINANCIAL SERVICES, INC. (AMP): Free Stock Analysis Report

The Blackstone Group L.P. (BX): Free Stock Analysis Report

Lazard Ltd. (LAZ): Free Stock Analysis Report

Original post

Zacks Investment Research