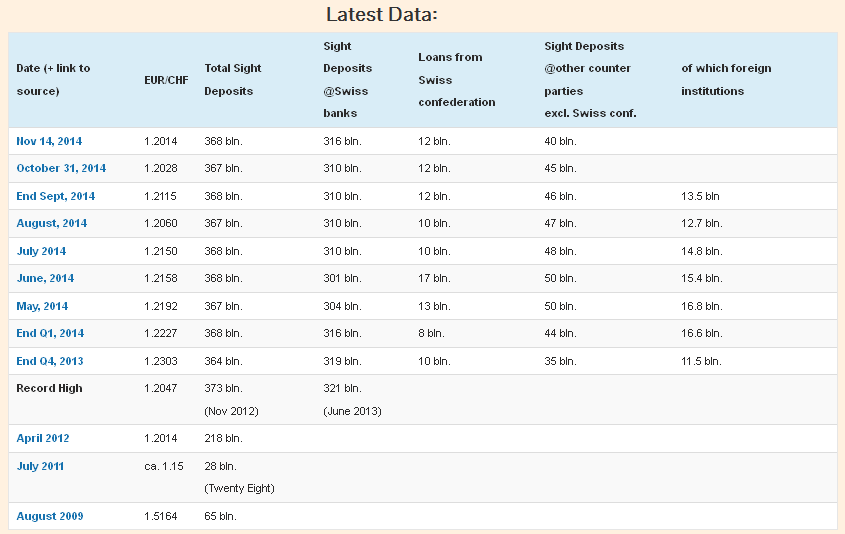

Sight deposits are currently the only means of financing for SNB currency (and maybe after the referendum for gold) purchases. The IMF-compliant weekly monetary data release on the SNB website provides the recent developments in sight deposits. Therefore the weekly monetary data gives an far earlier indication of of SNB interventions than the relatively late releases of balance sheet data.

The reader finds the latest data below.

Definitions:

Sight Deposits of Swiss banks. This is part of M0: Due to the money multiplier effect, then it would be a bigger issue than the increase of:

“Other Sight Deposits” of counter-parties with an account at the SNB (not included in M0 !). Inside the monetary data these include the Swiss confederation that gives loans to the SNB. These counter parties are also insurances, pension funds, investment companies and foreign banks and institutions. They are not part of M0, because they are not able to “multiple money” with loans to the public.

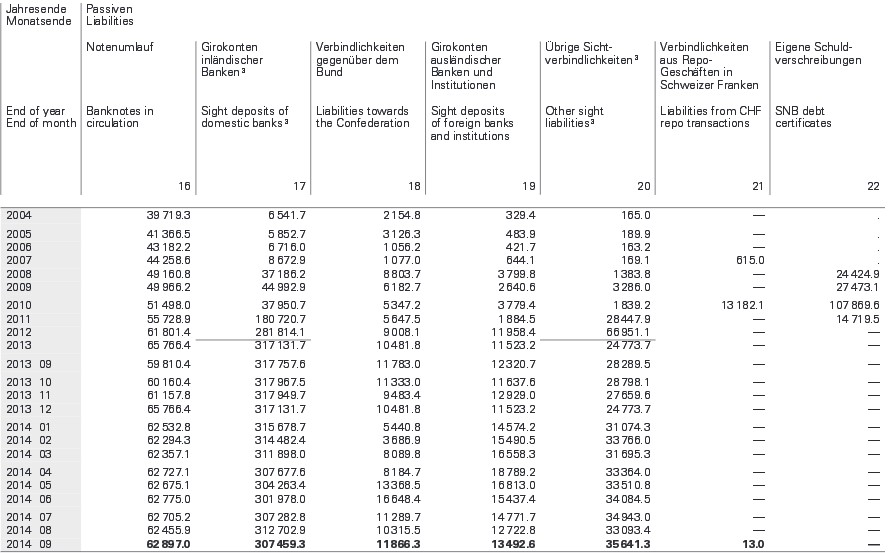

In the balance sheet the “other sight deposits” of the weekly monetary data are split into more details:

- foreign banks and institutions are shown separately (we list them also above).

- loans from the Swiss Federation to the SNB and

- misleadingly again an item called “other sight deposits”. These are the others above this time without the Swiss confederation.

Full Background and Explanation

The financing of SNB currency reserve purchases is currently realized using the funding local and international banks and companies provide and deposit at the SNB. This electronic transfer is commonly called “money printing” because it replaces the printing of paper money. Sight deposits are implicit loans from banks and companies to the SNB – currently honoured by 0% interest. Total sight deposits have increased to a total of 375 billion francs from 220 bln. at the beginning of 2012 and only 28 bln in 2011.

Together with around 60 billion of bank notes, the sight deposits provided by Swiss banks build up the so-called “central bank money” or “monetary base” M0. This central bank money M0 is combined with other (non-Swiss bank) sight deposits and around 60 billion SNB owners’ equity to obtain the total of 495 bln. SNB Liabilities, the means of financing the total of 495 billion SNB reserves, its assets.

This is the first way of looking at it: The SNB prints more money, increases its debt, in order to buy more foreign reserves and to keep the EUR above 1.20.

There is a second way of looking at it, it represents somehow an opposite explanation: The Swiss do not know how to invest their money obtained by trade and current account surpluses. Foreigners that seek safe-havens have the same problem. Instead of investing money abroad they leave the funds on their Swiss bank account.

By simple balance sheet logic, the Swiss bank needs to book an asset for the obtained cash liability to the client. The bank could decide to create a big cash vault or it could lend the funds to somebody. But nowadays, the Swiss bank does not want to take risks neither: it does not risk to lend neither in CHF, for Swiss mortgages or to lend in foreign currency, e.g. to a foreign bank in the weak euro members.

As opposed to lending, funds at the central bank neither weaken the Basel 3 ratios nor require additional counter-cyclical capital. It also opts against a big cash vault because it would have costs of maybe 0.1% of the total. (In the Swiss case there is a big economies of scale effect).

Instead the bank deposits the funds at the central bank as an (electronic) CHF sight deposit. Despite many francs ending up at the SNB, CHF lending for mortgages has heavily increased.

If the CHF exchange rate could freely float then sight deposits at the SNB would not increase, but the FX rate would adjust until there is less desire to hold CHF deposits. With a stronger CHF it would make more and more sense to buy foreign assets because those assets would become cheaper in CHF. Some critics (e.g. here at Inside Paradeplatz ) say that the SNB weakens the Swiss economy, because it buys foreign assets. This is not exactly true, because the SNB makes Swiss investments like houses and stocks but also loans cheaper than they would be in a free market, simply because CHF is cheap for foreigners. This leads to higher foreign demand and fuels the Swiss housing bubble.

Btw, quantitative easing works the same ways, the central bank provides cheap money so that investors can push up asset prices and improve business sentiment. In the SNB case, cheap Swiss money is used for both investing in Switzerland but also abroad, like when rich foreign bank clients use Swiss loans to finance their business abroad.