Growing USD strength in the wake of the Brexit referendum is presenting a serious challenge to the relatively low USD/CAD pair. Consequently, there could be a sizable recovery in store for the Loonie in the coming weeks, especially as the chaos in Britain worsens. Specifically, the technicals are now suggesting that the recent bullishness of the pair could be extended even in the absence of another major Brexit-related upset.

Firstly, as a result of the pair’s recent spike, the Loonie is finally presenting a real challenge to the 100 day EMA which has been providing some strong dynamic resistance. If the USD remains highly bullish, the Loonie might finally breakout from under the EMA and soar significantly higher in the short to medium turn. What’s more, on both the daily and H4 charts, the 12 and 20 period EMA’s are now reading bullish after a recent crossover. As a result, the 100 day EMA’s influence over the pair may be slipping.

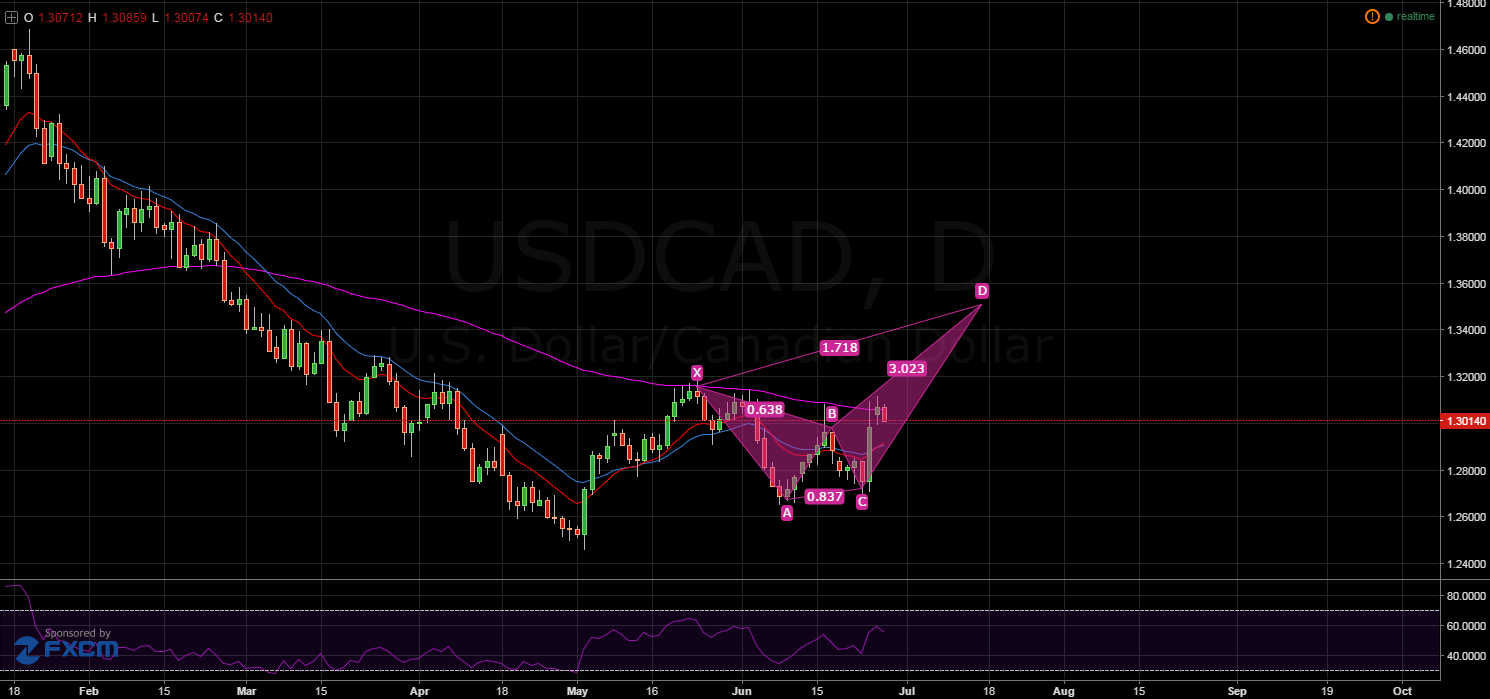

Additionally, the recent rally could be the beginning of the final leg in a Bearish Crab pattern which might also see the pair surge higher. As shown on the daily chart, the pattern has been forming for a number of weeks but the fallout from Brexit has gotten the final leg off to a flying start. Moreover, any further upsets out of the UK in the coming week will most likely ensure that the Crab completes. However, as is typical of this pattern, watch out for any corrections to the downside once the Loonie nears point D.

As shown on the H4 chart, if a breakout does occur, the Loonie should move into the zone of resistance around the 1.3633 – 1.3440 band. Once here, the pair is highly likely to reverse as the RSI oscillator will become highly overbought and the Parabolic SAR inverts once again. Presently, RSI is neutral whilst the Parabolic SAR remains firmly bullish which should encourage buying pressure to mount in the coming sessions.

Of course, sentiment surrounding the Brexit is currently the key force driving prices in the market as of late. As a result, news out of the UK is prone to sending much of the market into disarray at the drop of a hat. However, after the announcement that the UK has had its credit rating downgraded, another spike in USD strength is warranted. Consequently, the 100 day EMA’s dynamic resistance could be broken shortly.

Ultimately, technicals are somewhat dicey presently as the market remains racked by volatility and fear. However, at this point at least, the Loonie’s technical indicators are suggesting that a rally could occur in the imminent future. Additionally, the USD has been capitalising on this and as a result, the Loonie might be about to reverse a sizable portion of this year’s bearishness.