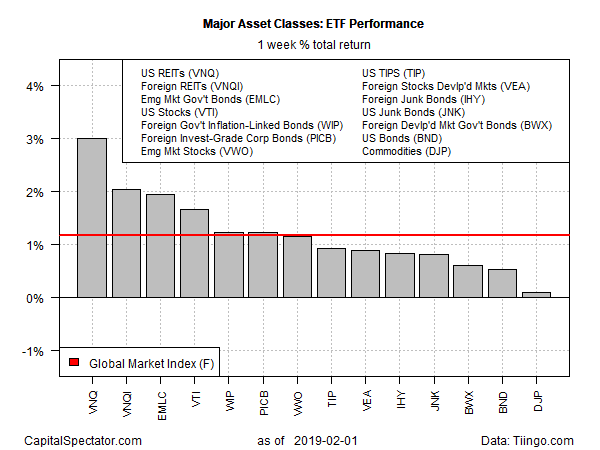

A global wave of risk-on sentiment delivered gains for all the major asset classes last week, based on a set of exchange-traded products through Friday, February 1.

Last week’s rally was led by real estate investment trusts (REITs) in the U.S. For the fourth week in a row, Vanguard REIT (NYSE:VNQ) was up, rising a strong 3.0%. The ETF closed the week just below an all-time high.

The weakest performer last week: broadly defined commodities. The iPath Bloomberg Commodity (NYSE:DJP) edged up a fractional 0.1%. The exchange-traded note has posted gains in four of the past five calendar weeks, although DJP remains well below its previous high.

Last week’s widespread gains lifted an ETF-based version of the Global Markets Index (GMI.F). This investable, unmanaged benchmark that holds all the major asset classes (except cash) in market-value weights rose 1.2% last week — the benchmark’s sixth straight weekly gain.

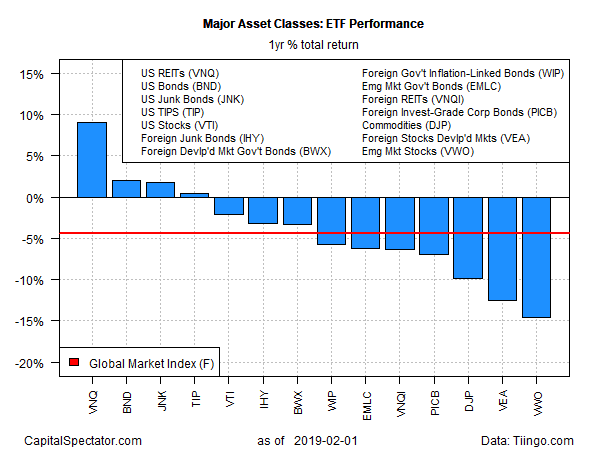

For the trailing one-year return, U.S. REITs are also in the lead – by a wide margin. VNQ is ahead by 11.5% in total-return terms as of Friday’s close vs. the year-earlier level.

The second-best one-year gain for the major asset classes is a relatively modest 0.8% advance for investment-grade U.S. bonds. Vanguard Total Bond Market (NYSE:BND) is holding on to a slight 0.8% increase for the past year after factoring in distributions.

Note, however, that most of the major asset classes remain under water for the trailing one-year change. The biggest loser for this time window: emerging market stocks. Vanguard Emerging Markets (NYSE:VWO), despite a six-week rally, remains in the red on a trailing one-year basis. At last week’s close, VWO was off 13.7% vs. the year-earlier price, even after factoring in distributions.

Meanwhile, GMI.F has shed a comparatively modest 4.4% for the past year.

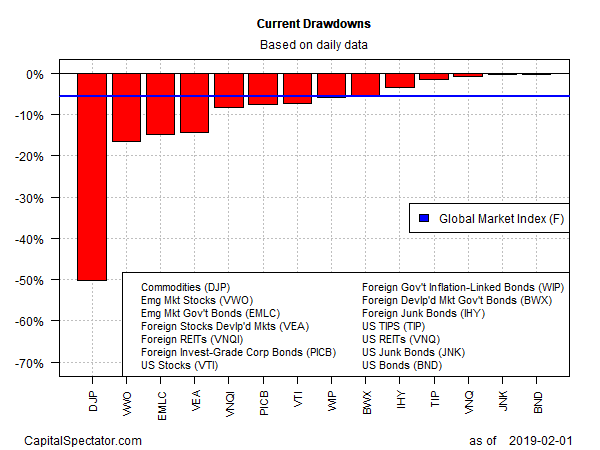

Reviewing the asset classes via current drawdown reveals that investment-grade U.S. bonds continue to post the smallest decline relative to the previous peak. BND’s drawdown at last week’s close was a mere -0.3%.

By contrast, broadly defined commodities are still posting the biggest drawdown. The iPath Bloomberg Commodity (DJP) has lost roughly 50% relative to its previous peak.

GMI.F’s current drawdown: -5.6%.