It’s been another week USDCAD bulls would like to forget. Currently below 1.3130, the pair is down by over 150 pips since the market opened on Monday. Earlier today, it actually dipped below the 1.3100 mark. Higher oil prices and lower-than-expected inflation in June seem like the logical explanations for the sharp drop in the US dollar against the Loonie.

While we are firm believers in studying and understanding the past, predicting the future is immensely more satisfying. In fact, we think the two are inseparable. One cannot hope to do the latter without having done the former first. In the case of USDCAD, studying the path the pair had already taken helped us anticipate its next several steps.

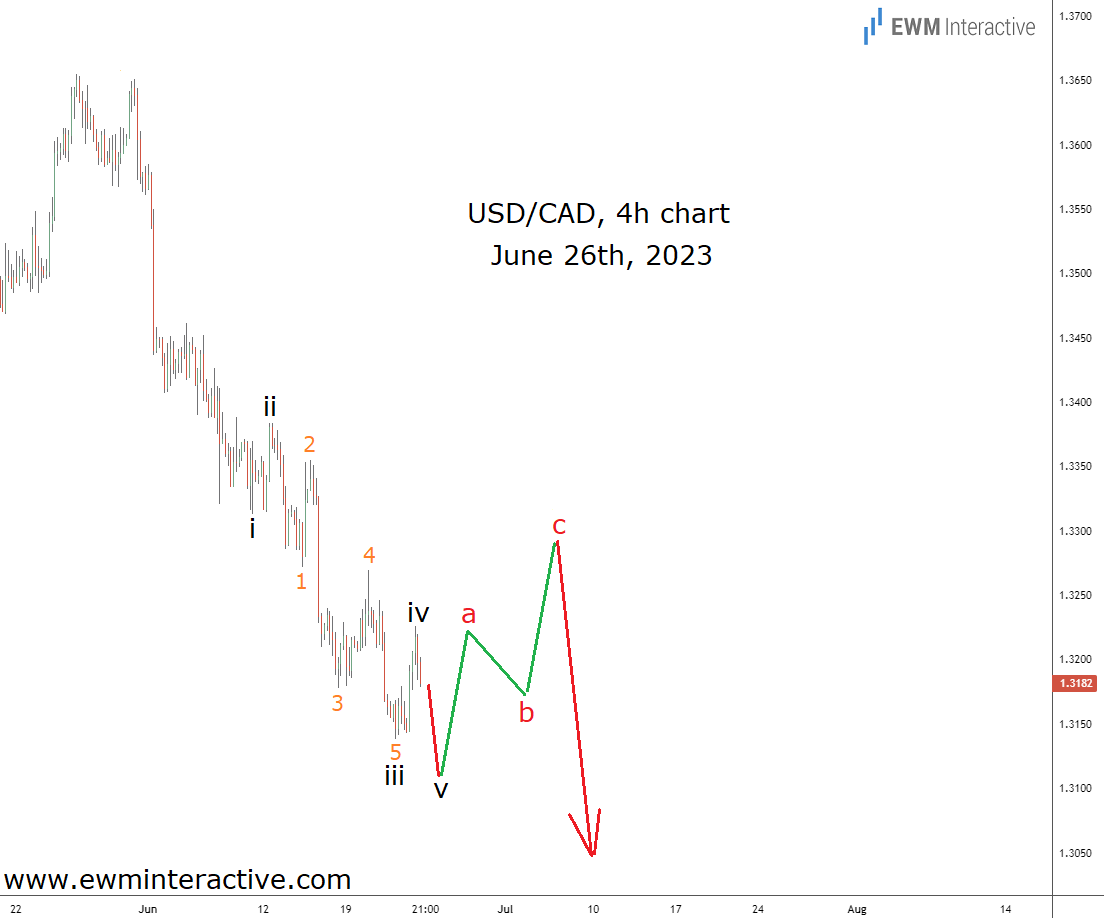

The chart above revealed that the decline from 1.3655, which Elliott Wave analysis also happened to put us ahead of, looked like an almost complete five-wave impulse. Labeled i-ii-iii-iv-v, the pattern indicated that once wave ‘v’ was over, a three-wave recovery can be expected before the downtrend can resume.

This wasn’t some random opinion of ours. It’s just a basic Elliott Wave rule, that states that a three-wave correction follows every impulse before the trend can continue. And while it is easy to explain things after the fact, in order to make money traders need to actually predict what would happen.

Here, a single chart and an eye for patterns put us three weeks ahead of not only the recovery, but the following selloff, as well. Wave ‘v’ completed the impulse pattern at 1.3117 on June 27th. The a-b-c corrective sequence then lifted USDCAD to 1.3387 on July 7th. And just when the bulls thought they had finally regained traction, the bears returned with a vengeance and erased the entire recovery. Just as expected.

Original Post