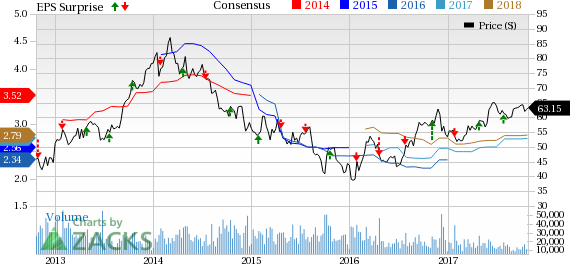

Las Vegas Sands Corp. (NYSE:LVS) just released its third quarter fiscal 2017 earnings results, posting earnings of 77 cents per share and revenue of $3.2 billion. Currently, LVS is a Zacks Rank #3 (Hold), and is up 1.65% to $63.95 per share in trading shortly after its earnings report was released.

The casino giant:

Beat earnings estimates. The company posted earnings of 77 cents per share, soaring past the Zacks Consensus Estimate of 67 cents per share; this number excludes 5 cents from non-recurring items. Net income was $685 million for the quarter.

Beat revenue estimates. The company saw revenue figures of $3.2 billion, topping our consensus estimate of $3.12 billion and increasing 7.7% year-over-year.

Consolidated adjusted property EBITDA increased 6% to $1.21 billion, while LVS said that hold-normalized adjusted property EBITDA surged 10.4% to $1.18 billion.

The company said that total net revenues for Sands China increased 12.2% to $1.93 billion, and The Venetian Macao generated revenues of $718 million.

"In Macao, the market continues to recover, while Sands China's Mass and VIP gaming volumes both outpaced the growth in the Macao market overall. That strong gaming performance, coupled with higher hotel occupancy and retail mall revenues, helped drive an adjusted property EBITDA performance of $652 million, our best quarterly result since the first quarter of 2014,” said Sheldon G. Adelson, chairman and CEO.

Las Vegas Sands is a hotel, gaming, and retail mall company headquartered in Las Vegas, Nevada. The company owns The Venetian Resort Hotel Casino, the Sands Expo and Convention Center, Venetian Interactive, an internet based venture, and Venetian Macao Limited, a developer of multiple casino hotel resort properties in The People's Republic of China's Special Administrative Region of Macao.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but chosen members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting today, and for the next month, you can follow all Zacks’ private buys and sells in real time. Our experts cover all kinds of trades: value, momentum, ETFs, stocks under $10, stocks that corporate insiders are buying up, and companies that are about to report positive earnings surprises. You can even look inside portfolios so exclusive that they are normally closed to new investors. Click here for Zacks' secret trades>>

Las Vegas Sands Corp. (LVS): Free Stock Analysis Report

Original post

Zacks Investment Research