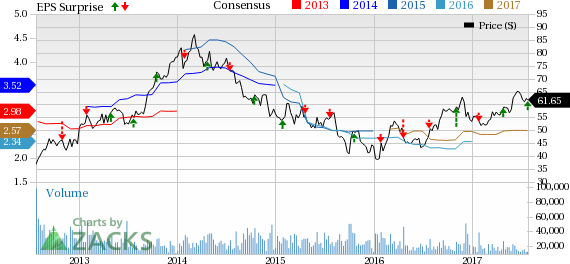

Las Vegas Sands Corp. (NYSE:LVS) reported better-than-expected second-quarter 2017 results with both earnings and revenues beating the Zacks Consensus Estimate.

Adjusted earnings per share (EPS) of 73 cents surpassed the Zacks Consensus Estimate of 61 cents by 19.7%, and increased 37.7% year over year owing to higher revenues.

Quarterly net revenues of $3.14 billion also topped the Zacks Consensus Estimate of $3.02 billion by over 4%, and increased 18.6% year over year. This improvement was primarily attributable to robust performance at its Las Vegas properties and mostly solid results in Macao.

On a consolidated basis, adjusted property earnings before interest, taxes, depreciation and amortization (EBITDA) was up 26.5% year over year to $1.21 billion during the quarter, owing to higher revenues.

Las Vegas Sands stated that the operating environment in Macao continued to improve during the quarter, with market-wide gross gaming revenues increasing 21.9%. According to the company, strong mass revenue growth along with higher hotel occupancy and growth in the VIP segment in the quarter drove its adjusted property EBITDA in Macao to $600 million, up 23%.

Notably, management is confident about Las Vegas Sands’ Cotai Strip portfolio of properties. It expects these properties to continue providing the economic benefits of diversification to Macao, help lure greater numbers of business and leisure travelers, and provide both Macao and the company with a superior platform for growth in the future.

Property Details: Asian Operations

The company's Asian business includes the following resorts:

The Venetian Macao

Net revenue rose 3.2% year over year to $687 million, owing to a 3.2% increase in casino revenues, a 5.9% improvement in mall revenues and a 16.7% gain in convention, retail and other revenues, offset to an extent by 8.9% and 4.8% decline in rooms revenues and food and beverage revenues, respectively.

Adjusted property EBITDA was up 4.9% year over year to $256 million in the reported quarter.

Non-Rolling Chip Drop rose 2.3% but Rolling Chip volume declined 24.7%.

Sands Cotai Central

Net revenue fell 5.9% year over year to $445 million, owing to a 7.9% decline in casino revenues and a 6.3% drop in mall revenues, somewhat offset by a 1.6% rise in rooms revenues along with a 4.2% increase in food and beverage revenues. Meanwhile, convention, retail and other revenues remained flat in the quarter.

Adjusted property EBITDA was $133 million, down 8.3% year over year.

Moreover, Non-Rolling Chip Drop and Rolling Chip volume fell 9.5% and 18.2%, respectively.

The Parisian Macao

Revenues soared 13.5% year over year to $361 million owing to a 15.4% surge in casino revenues and a 10.3% rise in rooms revenues. Notably, food and beverage, mall, along with convention retail and other revenues remained flat.

Adjusted property EBITDA jumped 29.3% to $106 million.

Meanwhile, though Non-Rolling Chip Drop dipped 1%, Rolling Chip volume witnessed an increase of 1%.

Going forward, the company expects The Parisian Macao to keep on delivering growth as the Macao market grows and as it continues to refine the property's service offerings to appeal to the fastest growing and most lucrative segments in the Macao market.

The Plaza Macao and Four Seasons Hotel Macao

Net revenue escalated 9.6% to $137 million, due to a 13.5% increase in casino revenues and a 20% improvement in food and beverage revenues. However, rooms revenues witnessed a decline of 11.1%. Meanwhile, mall revenues along with convention retail and other revenues remained flat.

Moreover, adjusted property EBITDA soared 34.1% to $59 million.

Both Non-Rolling Chip Drop and Rolling Chip volume increased 28.3% and 28.4%, respectively.

Sands Macao

Revenues decreased 13% year over year to $161 million, owing to a 12.8% decline in casino revenues and a 50% plunge in convention retail and other revenues. Notably, food and beverage rose 16.7% while rooms revenues remained flat during the reported quarter.

Adjusted property EBITDA declined 18.8% to $39 million.

Moreover, Non-Rolling Chip Drop and Rolling Chip volume decreased 3.7% and 50.5%, respectively.

Marina Bay Sands, Singapore

Net revenue rose 17.7% year over year to $836 million, owing to a 23.9% increase in casino revenues. While rooms revenues, food and beverage revenues, and convention retail and other revenues fell 3.6%, 6.5% and 4.2%, respectively, mall revenues remained flat,

Adjusted property EBITDA in the quarter was $492 million, up 37.8%.

Though Non-Rolling Chip Drop fell 2.7%, Rolling Chip volume increased 29.2%.

Notably, Marina Bay Sands' inventive programming, steady mass gaming play, potent non-gaming revenues and higher hold in VIP play boosted its performance in the reported quarter.

Domestic Operations

Las Vegas Operations

Net revenue from Las Vegas operations, which comprise The Venetian Las Vegas and The Palazzo, was up a solid 7.9% year over year to $384 million owing to a 19.5% rise in casino revenues and a 15.6% improvement in convention retail and other revenues. The results were however somewhat offset by 2.1% and 2.6% decreases in rooms and food andbeverage revenues, respectively.

Adjusted property EBITDA rose 9.7% year over year to $79 million.

However, Table Games Drop fell 6.1% in the quarter.

Sands Bethlehem, PA

Net revenue at Sands Bethlehem was $147 million, up 0.7% year over year attributable to a 0.7% rise in casino revenues. Rooms, mall, and convention, retail and other revenues remained flat in the quarter. However, food and beverage revenues declined 12.5%.

Adjusted property EBITDA was down 2.6% year over year to $37 million.

Moreover, Table Games Drop was down 4.5%.

Zacks Rank & Peer Releases

Las Vegas Sands has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In second-quarter 2017, Wynn Resorts Ltd. (NASDAQ:WYNN) posted adjusted earnings of $1.18 per share that outpaced the Zacks Consensus Estimate of $1.09 by 8.3%. Further, earnings increased 10.3% from the year-ago figure of $1.07, mainly backed by higher revenues.

Among other casino operators, Eldorado Resorts, Inc. (NASDAQ:ERI) is slated to release its second-quarter numbers on Aug 8, while Pinnacle Entertainment, Inc. (NASDAQ:PNK) is scheduled to report on Aug 10. The Zacks Consensus Estimate for the quarter’s earnings is pegged at 25 cents and 23 cents for Eldorado Resorts and Pinnacle Entertainment, respectively.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Las Vegas Sands Corp. (LVS): Free Stock Analysis Report

Wynn Resorts, Limited (WYNN): Free Stock Analysis Report

Pinnacle Entertainment, Inc. (PNK): Free Stock Analysis Report

Eldorado Resorts, Inc. (ERI): Free Stock Analysis Report

Original post

Zacks Investment Research